GBP / USD pair

Yesterday, the British pound rose to 63 points due to words of Mark Carney in a speech with a report on inflation in parliament. He said that rates could be raised in a few months if the recent weak economic indicators proved to be temporary. But since the fact that the growth occurred only on Karni's speech without any new promises, the price returned to its initial position to the inflation data and the publication of the FOMC protocol.

The base consumer price index in the UK for April is expected to decrease from 2.3% y/y to 2.2% y/y while the total CPI is projected without a change of 2.5% y/y. The producer price index (PPI) at the beginning of the previous month is expected to grow by 1.0% against -0.1% in March (5.8% y/y vs 4.2% y/y). The PPI output may add 0.3%. The index of residential property prices from Halifax is expected without a change in 4.4% y/y. The balance of retail sales from CBI can increase from -2 to 4 in May.

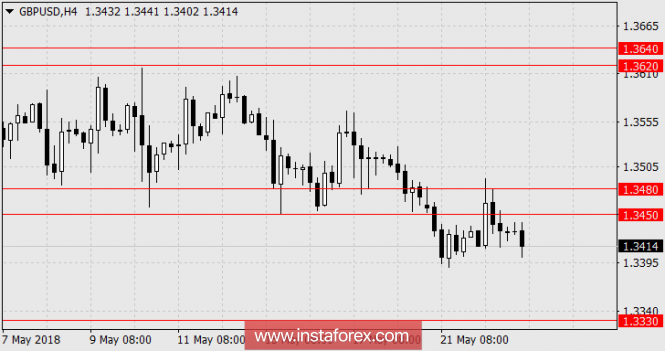

Based on the volume, the data can be considered weakly positive, and then the decisive factor will be the reaction of investors to the "minutes" of the FOMC FRS. At the moment, market participants are laying 3.5 rate hikes by the end of the year and a 100% chance of an increase in June. From these positions, the movement of the pound is likely to reach 1.3330.