AUD/USD has been quite impulsive with the bullish gains recently. As a result, the price is hovering above 0.75 after breaking below it with a daily close. The pair is trading with volatility after being dominated by USD since the price broke below 0.7750 area with a daily close.

AUD has been struggling for gains amid recent economic reports which made AUD to give in to stronger USD. Today, Australia's Home Loans report was published with a greater deficit to -2.2% from the previous value of -0.2% which was expected to be at -1.9%. Despite the worse-than-expected economic report published today, AUD has managed to gain momentum over USD because of the recent disappointing CPI report from the US. The market sentiment seems to be in favor of AUD in this case that is expected to extend further in the coming days.

On the USD side, today Import Prices report is going to be published which is expected to increase to 0.5% from the previous value of 0.0%, Prelim UoM Consumer Sentiment report is expected to decrease to 98.4 from the previous figure of 98.8, and Prelim UoM Expectation is expected to increase from the previous value of 2.7%.

As for the current scenario, the forecasts for the USD economic reports are quite mixed in nature which might lead to certain indecision and volatility upon release today. As for the current gains on the AUD side today, further bullish momentum is expected in this pair until the US comes up with better economic readings to support USD.

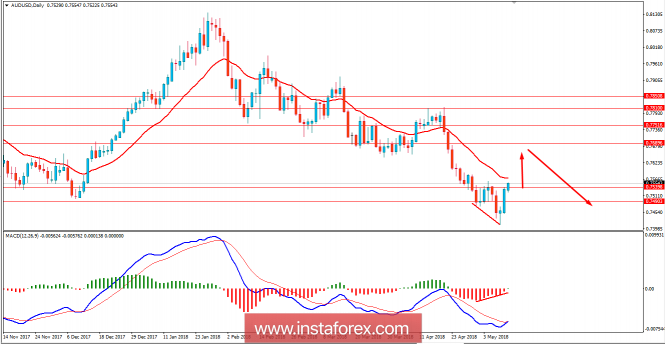

Now let us look at the technical view. The price is currently quite impulsive with the bullish gains trying to push above 0.7550. Certain Bullish Divergence is being spotted in the process which is expected to lead to further bullish momentum in this pair with a target towards 0.7700-50 area from where the price may retreat back lower in the future. Though the dynamic level of 20 EMA may work as a strong resistance for the price but against the impulsive bullish pressure it had already evolved, further bullish pressure is expected as the price remains above 0.7500 with a daily close.