EUR/GBP has been quite bearish and volatile recently above the support area of 0.8700-50. Both EUR and GBP has been struggling with the economic reports published recently whereas EUR seemed to have an upper hand over GBP for last few weeks.

Ahead of the upcoming Uk's Bank Official Rate and the BOE Inflation report, which is to be published tomorrow, the market is currently quite indecisive and volatile. Though the Official Bank Rate is expected to be unchanged at 0.50% but certain volatility is expected in the market as the news publish. Today BRC Retail Sales Monitor report was published with a decrease to -4.2% from the previous value of 1.4% which was expected to be at -0.7%. The worse economic reports of GBP were not quite effective for EUR to gain impulsive momentum over GBP, whereas the market still remains indecisive and corrective.

On the other hand, today the French Industrial Production report was published with a decrease to -0.4% from the previous value of 1.1% which was expected to be at 0.4%. Besides, the Italian Retail Sales report was also published with a decrease to -0.2% from the previous value of 0.7% which was expected to be at 0.1%.

As of the current scenario, both currencies in the pair are going through worse economic reports for which the definiteness of the upcoming trend momentum is still on hold. Though EUR has been the dominant currency in the pair for last few days but ahead of the upcoming GBP high-impact economic reports may also lead to certain indecision and volatility. To sum up, EUR is expected to extend its gains over GBP in the coming days if GBP report and events remains neutral in nature.

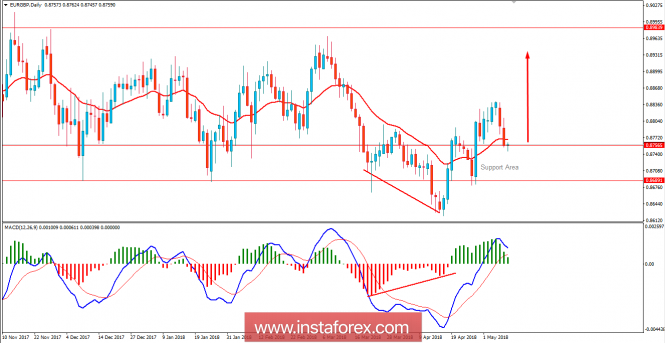

Now let us look at the technical view. The price is currently residing at the edge of 0.8750 from where it is expected to gain further bullish momentum in the coming days. After the recent false breakout below 0.87 price area with a daily close, the bullish momentum forming a Bullish Divergence is still quite active and expected to push the price higher towards 0.90 resistance area in the coming days. As the price remains above 0.87 with a daily close, further bullish pressure is expected in this pair.