USD/CHF has been quite volatile recently inside an impulsive non-volatile bullish trend since the price bounced off the 0.9200 support area. USD has been the dominant currency in the pair for a long time whereas CHF has been struggling with downbeat economic reports. After certain impulsive pressure for months, certain volatility and correction made the market sentiment quite counter biased which is expected to lead to certain bearish momentum in the market.

Today, US Unemployment Claims report was published with an unexpected increase to 222k from the previous figure of 211k which was expected to be at 216k and Philly Fed Manufacturing Index report was published with an increase to 34.4 from the previous figure of 23.2 which was expected to decrease to 21.1. Moreover, today US CB Leading Index report is going to be published which is expected to increase to 0.4% from the previous value of 0.3% and Natural Gas Storage is also expected to increase to 105B from the previous figure of 89B.

On the CHF side, Swiss National Bank Chairman Jordan spoke recently about the recent struggle of the economy which is expected to recover with a limited pace in the process but SNB is already taking some steps to recover the lost grounds soon.

As for the current scenario, CHF is expected to put pressure on USD for a while in the coming days but the momentum of USD is expected to continue further after certain retracement along the way. Upcoming economic reports from Switzerland and the US will help the market sentiment to continue or change the future bias of the market.

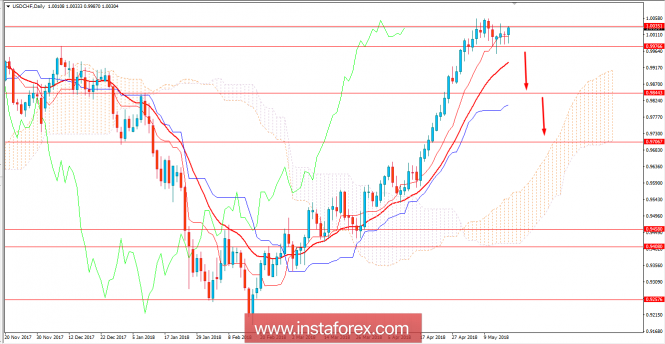

Now let us look at the technical view. The price has been ranging between the resistance area of 0.9980 to 1.0040 area from where it is expected to push lower if a daily close below 0.9980 is observed in the coming days. The dynamic level Tenkan Line has been supporting the bullish gains of USD along the way which is currently being observed violated in the process. As the price remains below 1.01 price area with a daily close, there are certain chances of bearish intervention in the market.