The oil market feels very confident. A barrel of Brent crude oil is traded in the area of $ 79, while WTI fluctuates around 72 points. Aggravated relations between the US and Iran, as well as the results of elections in Venezuela give impetus to oil quotes, but not all commodity currencies take advantage of the current situation.

In particular, the Canadian dollar has recently weakened and weaker correlations with the oil market. Despite the steady growth of "black gold", the Canadian demonstrates contradictory dynamics, especially in tandem with the US dollar. This situation is due to several fundamental factors. We will analyze each of them.

The oil market, of course, plays an important role for the Canadian economy. But now, the national currency actually ignores the growth of quotations. This is primarily due to concerns of traders about possible failures in the transportation of "black gold" from Canada to the United States. The fact is that Americans are the main buyer of Canadian oil, so the question of infrastructure is the key. In turn, one of the routes, the Enbridge Line 3 pipeline is obsolete (it was built almost 60 years ago), in connection with which it was required to replace it. Due to its unsatisfactory technical condition, it operates only 45% of its capacity.

However, against the large-scale reconstruction worth 2.6 billion dollars were made by American ecologists and representatives of Indian tribes. Enbridge Energy spends millions of dollars lobbying this project, but the situation is still in limbo. In late April, the Minnesota Court adopted a positive, but not final decision for the oil industry. The judge only recommended that the appropriate regulator approve the replacement of the pipeline along this route.

Earlier in the US, a bill was passed that allowed Enbridge to build a new route without the approval of the regulator. But Governor of Minnesota Mark Dayton vetoed this bill the day before yesterday. Now, Canadians are waiting for an important verdict of the Minnesota Public Service (PUC). In June, officials should approve or prohibit large-scale construction. If the decision is in favor of Canadians, then the pipeline after reconstruction will restore its original capacity, almost 800 thousand barrels per day. However, according to some experts, the regulator can take the side of ecologists and Indian tribes through whose territory the oil route passes. On the scale of the global oil market, this factor has little effect on the situation, but the pair USD / CAD reacts quite sharply to this uncertainty.

Moreover, not only this fundamental factor negatively affects the rate of the Canadian currency. Recently it became known that the deficit of trade in goods in Canada rose to a record 17.6 billion Canadian dollars due to increased trade gaps with the EU and the PRC.

Another factor of uncertainty is related to the long-suffering negotiations on NAFTA (ie, the North American Free Trade Agreement). Dialogue again came to a standstill, Canadians and Mexicans took a time-out to study the new proposals of the American side. At the same time, the "deadline" is coming soon. The negotiators should come at least to some compromise in the coming month, because on July 1 in Mexico, the pre-election presidential race begins, and then in November there will be elections to the US Congress.

It should be noted that the parties are discussing the revision of the Agreement for almost a year, so they are unlikely to come to a common denominator within the next five weeks. Just the day before yesterday, US Treasury Secretary Steven Mnuchin said that in this issue "the main points remain unresolved", despite the general desire to find a compromise.

The Bank of Canada, in turn, repeatedly stressed its focus on the uncertainty surrounding the NAFTA. According to Stephen Poloz, the protracted negotiations reduce the investment climate in the country, negatively affecting the dynamics of GDP growth.

The above circumstances neutralize the effect of rising oil prices. Without any "own arguments" for growth, the Canadian has to follow the US dollar, which again demonstrates strength throughout the market (with the exception of the pair USD / JPY, due to the renewed uncertainty about the US-China trade talks). The minutes of the May meeting of the Federal Reserve published today may give impetus to the Greenback if its tone turns out to be a "hawk" against the background of the uncertain rhetoric of the accompanying statement. In this case, the pair USD / CAD will approach the March price maximum of 1.2950.

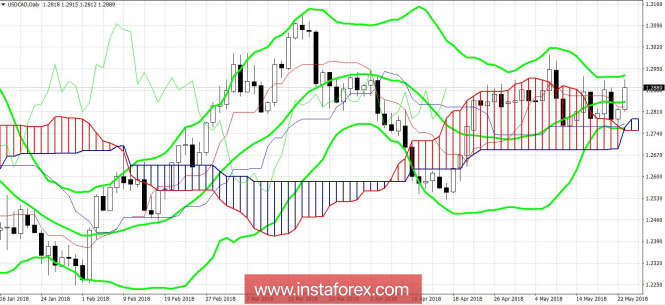

Technically, the pair continues to be in the bright north trend. This is confirmed by the main trend indicators, Ichimoku Kinko Hyo and Bollinger Bands. So, the indicator Ichimoku Kinko Hyo formed a bullish signal "parade lines", and Bollinger Bands is in the narrowed channel, with the price almost touched its top line. The immediate goal of the northern movement is the upper line of the above indicator, which corresponds to the level of 1.2950. If bulls USD / CAD overcome and are fixed above this level, the path will be opened to the area of 30 figures.

The material has been provided by InstaForex Company - www.instaforex.com