Eurozone

At the opening of the week, the euro was expected to resume its decline, as economic reasons for the resumption of growth are not visible, and the geopolitical background for the European currency remains tense.

In Italy, probably the emergence of a coalition agreement "5 stars" and "League of the North", which can give a start to Italy's exit from the euro area and the rejection of the euro. Today, as expected, the name of the new prime minister will be announced, and if the fears of the market are confirmed, the euro may fall even more.

On Friday, the European Commission announced a series of protective measures against US sanctions in connection with the withdrawal of the latter from the Iranian deal. European companies are forbidden to carry out extraterritorial sanctions of the US, the market is expected to react with a decline in the euro.

On Monday in a number of European countries a day off, the euro can experience increased volatility in a thin market, but the general direction is not in question. On Wednesday preliminary data of PMI Markit will appear, the forecast is unfavorable, further growth slowdown is expected. On Thursday, the protocol of the ECB's April meeting will be published, most likely, it will not contain any positive for the bulls for the euro.

The euro may well drop to 1.1640 in the next 24 hours before trying to find a support for correction, in the slightly longer term the level of 1.1550 is quite achievable by the end of the week.

The United Kingdom

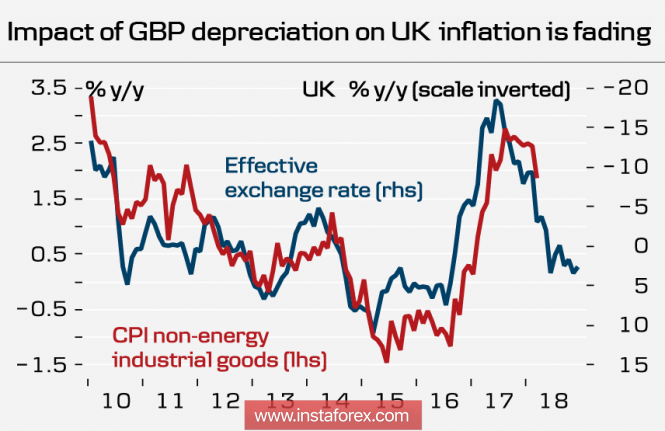

The external background for the pound looks calm at the beginning of the week, but already from Wednesday the intensity of macroeconomic publications will increase. The publication of inflation data for April could have a significant impact on the assessment of the future prospects for the pound. More recently, the Bank of England was forced to abandon the rate hike that the markets had expected for almost half a year, and one of the main reasons for this decision was the slowing of inflation at a more rapid pace in recent months.

The effect of the weak dollar is disappearing, since it has been almost two years since the referendum, and the main drop of the pound has already been won, and inflation slows to 2%, which reduces the grounds for tightening monetary policy.

On Thursday, a report on retail sales will be released in February, which will partly answer the question of the causes of weak inflation, and also the speech of BoE head Mark Carney is expected.

On Friday, the second estimate on GDP in the first quarter will be published, which, according to forecasts, can be revised upward. Also on Friday, there will be data on the dynamics of commercial investment, the market will be able to understand how strong the position of the UK in the negotiations for withdrawal from the EU.

In general, the pound is at the opening of the week under strong pressure, there is no reason to wait for its growth. A decrease to 1.3300 may occur in the coming days.

Oil and ruble

Futures for Brent tested the level of 80 dollars per barrel, and, apparently, this is far from the limit.

The US withdrawal from the nuclear deal with Iran is directed, first of all, to the European governments, which, according to Washington, must show the Atlantic Atlantic solidarity and put their own interests below the interests of the United States. This position has not been understood by European politicians. Iran and the European Union set up a working group on oil trade and are determined to keep the agreement even without Washington's participation.

Oil prices are pushing upward and the political crisis in Venezuela, Nicols Maduro does not recognize the presidents as a result of the elections, neither opposition, nor, it seems, Washington, and hence the risk of sanctions pressure on the oil industry of the country.

Oil has every chance to reach this resistance zone at 81.40 / 90 this week.

The ruble has not yet been able to play a positive role in the growth of oil prices, as geopolitical risks have increased. The US dollar is in the growth phase, besides, the likelihood of new sanctions against Russia has increased again, while the Ministry of Finance continues to purchase currency, which eventually allowed the ruble to fall to 62.6 rubles / dollar. At the same time, there are also positive factors - the beginning of the tax period (payments for MET and VAT), and, of course, the price of oil.

Most likely, the positive factors will still outweigh, and so the ruble will move to 61.60, this scenario is more likely to be realized that the rise to the upper boundary of the narrowing trading range of 63.40.

The material has been provided by InstaForex Company - www.instaforex.com