After a short pause, the US dollar again began to strengthen, growing against the euro to a 6-month high at the trades on Wednesday. The markets once again felt a taste for risk, which is reflected in the stable growth of yields on government bonds and the increase in the stock markets on both sides of the Atlantic.

What are the reasons for this optimism?

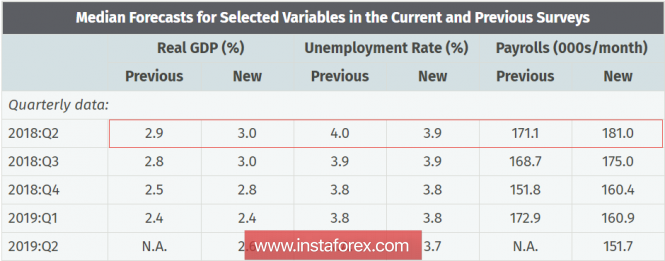

The Philadelphia Federal Reserve published a forecast for the main economic indicators of the US for the next four quarters. Compared with the results of three months ago, there is a clear improvement in the forecast for almost all points: GDP growth is expected to be at 3.0% in Q2 against 2.9% in the previous forecast, moreover, forecast for the third and fourth quarters has also improved.

It is expected that unemployment in the current quarter will decline slightly more than previously forecast, and, of course, one of the main indicators of economic growth, the pace of creating new jobs, has been revised upward.

Perhaps only the forecasts for inflation are the ones that don't look so confident. However, in this case, it is expected that by the end of the year, the results will be positive and some slowdown in the second and third quarters should, in the opinion of the Federal Reserve Bank of Philadelphia, be offset by a higher price increase in the fourth quarter with the annual inflation rate at the level of 2.3%.

Similar results are obtained by other regional offices of the Federal Reserve, forming a picture of the confident growth of the US economy, which in the end justifies the Fed's policy of normalizing interest rates and reducing the balance. According to CME, two rate increases in June and September does not cause doubts in the market. The probability of a fourth increase in December is now 50% higher, which gives the dollar grounds for expecting a long and steady growth.

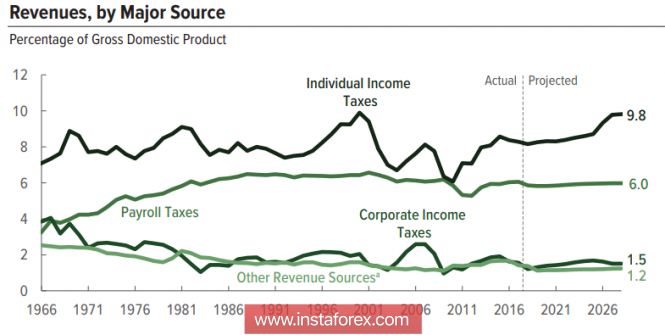

We also note the negative aspects. The tax reform has not only revived consumer activity and production growth, but also led to a significant decrease in budget revenues, which must be compensated. The growth of income tax is possible only after the industry starts to grow confidently and the trade balance begins to be corrected.

This is what Donald Trump, who pursues a policy of aggressive pressure on China and the European Union, is going to make them finance American reforms.

In both directions there are prerequisites to fail. After the aggressive start of negotiations on May 3, when the US delegation unequivocally demanded from China to increase the import of American goods and reduce the trade deficit to $ 200 billion, there was a rapid easing of the position once it became clear that China's retaliatory measures could cause significant damage to the US economy. The national strategy "Made in China 2025" threatens the US with the loss of global technological leadership. It is the interest of the US to prevent implementation of these plans but excessive pressure will only accelerate their implementation.

Thus, financing of the US budget deficit by China is under big question, and this is a negative factor for the dollar, which will gain strength in the next few months.

As for the US withdrawal from the nuclear deal on Iran, it would make sense only if this step did not become one-sided. However, in reality, everything turned out the other way round: the volume of oil trade on the Shanghai Stock Exchange rose to 12% of global consumption, which means that the petrodollar is rapidly losing its positions.

The second blow came from Europe. The EU countries do not intend to blindly follow the US strategy and exit from business in Iran, for which they began to develop a trade scheme with, not for the dollar, but for the euro. In fact, the point is that an attempt by the US, through pressure in forcing its trading partners to participate in financing the US economy, can lead to the opposite effect: the creation of parallel financial contours, in which the dollar will be excluded.

Until the end of the week, the dollar will remain the leader of the market. It can be expected that there will be a test at 1.17 paired with the euro and 1280 on gold. It will likely grow against the yen to 110.85. The positions of commodity currency against the dollar will not be lost due to a sharp increase in the cost of oil.

The material has been provided by InstaForex Company - www.instaforex.com