Political instability in Italy and Spain continues to exert pressure on European investors, as well as on the rate of the European currency.

The coming to power of a coalition of Eurosceptics in Italy called into question the existence of this country within the European Union. On this wave, investors significantly reduced interest in buying risky assets and the euro remains under the strongest pressure which could lead to the exit of the country from the EU by the type of British Brexit. In addition, the events in Spain also pour oil, as they say, into the fire. The vote of no confidence in the government of M. Rajoy from the side of the president of the country led to the government crisis, which, in conjunction with the Italian, is shaking the European political "boat".

As for the dynamics of the Euro-currency, at the moment, it is completely dependent on two factors - the political instability in Europe and the strengthening of the US dollar's position due to the expectation of the further process of raising interest rates by the Fed. Given this, we believe that the euro will continue to decline in the short term, paired with the US dollar.

A similar picture is observed in the GBP/USD pair. Despite the fact that the continental European crisis does not directly concern the UK, the unresolved situation surrounding the country's withdrawal from the EU, as well as the actual beginning of the trade war between the US and China, will exert pressure on the world economy, including Britain, which already feels a downward impulse.

Yesterday, the US reported that on June 15, a list of goods will be announced for which import duties will be raised by 25% for a total of $ 50 billion. In addition, it was announced that restrictions will be imposed on the investment activities of US companies in China. This news shows that the talks between Washington and Beijing failed and although this morning, there was news that a new delegation from the United States is traveling to Beijing, it looks like nothing can stop the trade war.

Given the fact that the economic rivalry between the US and China turns into a trade war, it can be said that this will probably seriously damage the global economy, which means that the demand for risky assets will continue to fall therefore putting pressure on the Aussie, New Zealand, and Canadian dollars. There may be pressure on the a Russian ruble due to the possible continuation of the correction of prices for crude oil. The euro and sterling will suffer not only from their internal histories, but also from the external factor of the trade war. It is likely that in this situation, the yen and the Swiss franc, as assets of a safe haven, will also benefit.

Forecast of the day:

The EURUSD pair remains in the short-term downtrend. We expect that it will continue to decline in the wake of the upcoming interest rate rises in the States in June, as well as against the backdrop of political events taking place in Italy and Spain. On this wave, the pair may fall to 1.1440 after overcoming the 1.1525 mark.

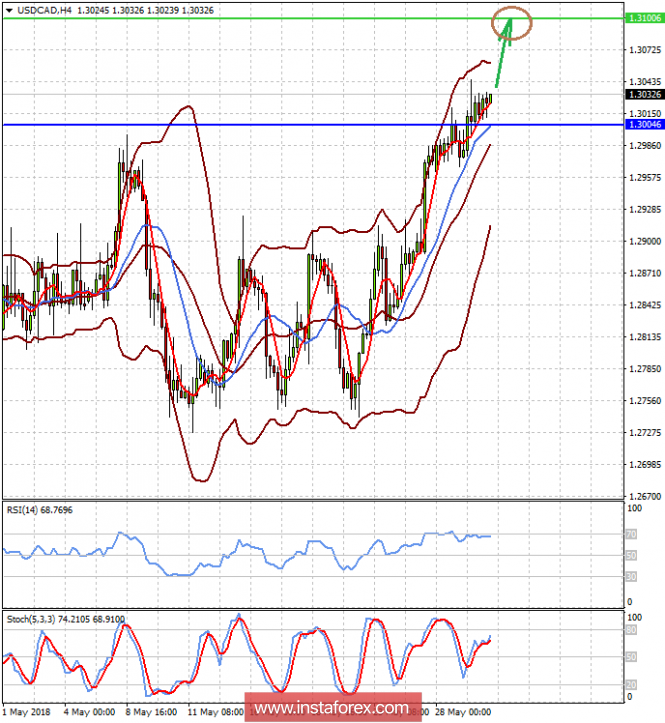

The USDCAD pair is trading above the level of 1.3000. The pair may continue to rise against the background of a possible weakening of crude oil prices. On this wave, we expect it to rise to 1.3100.