Overnight trading during the Asian session remained in standby mode following the sleepy sessions in Europe and the US on Monday. Investors are also waiting for the decision of President Trump regarding the nuclear contract with Iran. USD and JPY are holding tight. Data on China's foreign trade showed a surplus return in April of USD 28.8 billion, slightly more than expected to USD 27.8 billion. Export increased by 12.9% y/y (exp: 8.0%), and import 21.5% (exp: 16%). The US trade surplus also increased - to USD 22.2 billion from USD 15.4 billion in March. Good data from Chinese foreign trade help stock exchanges: Shanghai Composite grows 0.7%, and Nikkei 225 gains 0.1%.

On Tuesday 8th of May, the event calendar is light in important data releases, but the global investors should keep an eye on Switzerland Unemployment Rate data, German Industrial Production and Trade Balance data, Halifax House Price Index data from the UK, Australian Annual Budget data, Housing Starts data form Canada and JOLTs Job Openings data from the US.

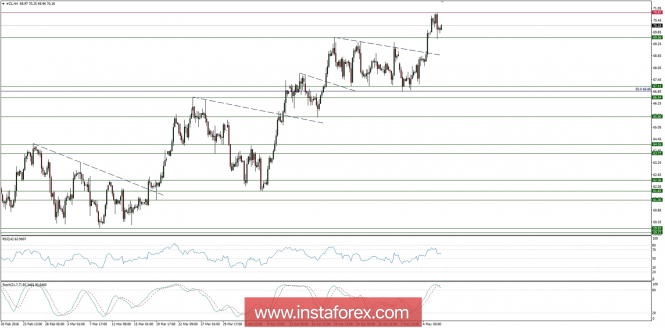

Crude Oil analysis for 08/05/2018:

Crude oil loses on Tuesday and moves away from more than three-year highs. Strong increases from Monday were interrupted by President Trump's tweet that today, at 14:00 Standard Eastern Time, that said he will announce the decision on the nuclear contract with Iran. Investors are likely to make a profit in the event that Trump decides to prolong the deal.

The tense geopolitical situation in the Middle East and the deteriorating economic situation in Venezuela as two hotspots for a sudden oil supply disruption, which could send the oil price higher and affect the currency markets as well. Focus is now on Iran, as the waiver on US sanctions related to the 2015 nuclear deal expires on 12 May.

US President Donald Trump has argued against a continuation of the current nuclear deal and there is a tail risk where sanctions related to Iran's oil exports are reinstated.

Let's now take a look at the Crude Oil technical picture at the H4 time frame. The market has made a new marginal high at the level of 70.82, the higher level since 2014. The immediate technical support is seen at the level of 69.56 and only a clear and sustained breakout below this level would indicate a potential corrective pull-back towards the consolidation zone at the levels of 67.11 - 66.54. The growing bearish divergence supports the short-term pull-back scenario, together with overbought market conditions.