Last week the downward medium-term movement of the pair resumed after a short set of a new position and the unloading of some of the old selling. This makes it possible to look at the depreciation at the same angle as two weeks ago.

Banking ranges.

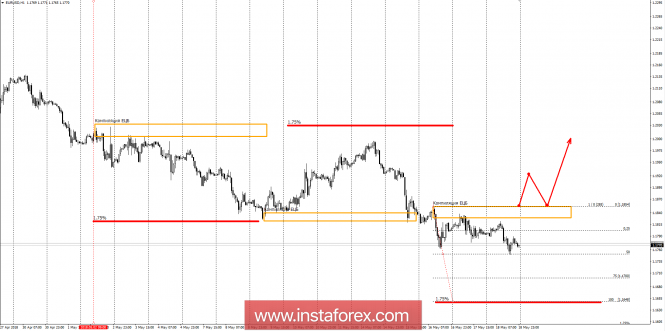

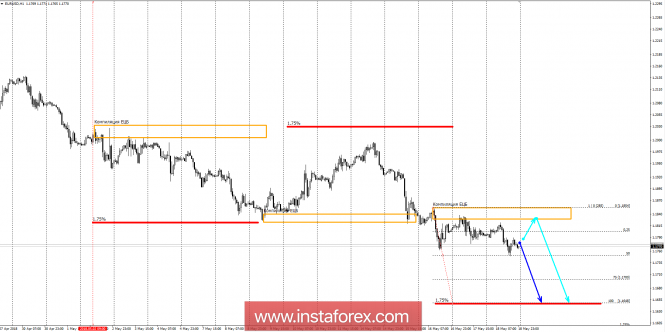

To analyze the situation, consider the movement in the last three weeks. The first thing that catches your eye is the increase in the rate of two weeks ago, which fits into the Fed's interest rate of 1.75%. The resumption of the depreciation indicates continuing operations that do not prevent the weakening of the European currency. The deadline of the previous medium and the movement relative to it indicate a medium-term downward priority. The purpose of the decline can be set at an interest rate range of 1.75% (1.1648).

The main trading decisions should be aimed at finding selling of the trading instrument as close as possible to the ECB's compilation area. The purpose of the fall is the level of the Fed's interest rate 1.1648. Selling will have a favorable risk-to-profit ratio, and since the downward movement remains a medium-term momentum, the probability of it working out will be 70%.

The formation of an alternative growth model will require the absorption of the last fall of the pair from the previous environment. The rate should be fixed above the zone of bank compilation, which will allow considering the cancellation of the descending model. Buying will still be corrective, but they can already be considered as an alternative, on an intraday-intraday level. The position of the new compilation of the ECB will be important, which will happen on Wednesday.