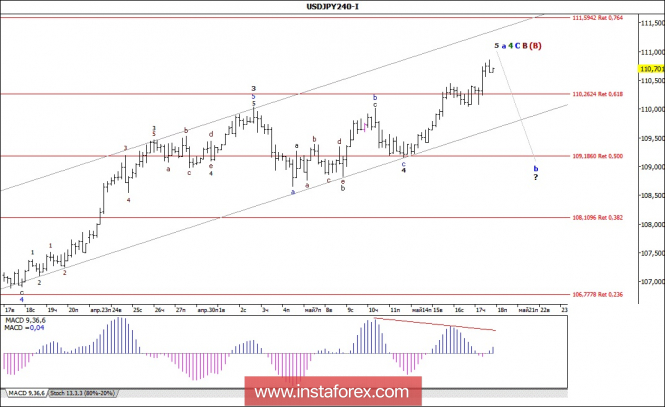

Analysis of wave counting:

In general, it is expected that during the yesterday's trading, the currency pair USD / JPY continued to develop the upward movement and stopped at the level of 110.85 in the afternoon. Thus, we can assume that the currency pair remained in the formation stage somewhat complicating its wave structure of the wave 5, a, 4, C, C, (B). If this is so, then working off the level of the 111th figure can lead to a price turn against the dollar and the beginning of the formation of the future wave b, 4, C, C, (B).

The objectives for the option with purchases:

111.00

111.59 - 76.4% of Fibonacci

The objectives for the option with sales:

109.18 - 50.0% of Fibonacci

108.10 - 38.2% of Fibonacci

General conclusions and trading recommendations:

The upward wave 4, C, C, (B) continues its construction, complicating the internal wave structure. Thus, I recommend buying a pair with targets that are about 111 figures and an estimated level of 111.59, which is equivalent to 76.4% of Fibonacci. I recommend to go back to sales after the completion of wave 4, which can be determined, for example, on the output of the tool from the upward corridor. The MACD divergence warns of the readiness to build a downward set of waves in the near future.

The material has been provided by InstaForex Company - www.instaforex.com