Facebook is withdrawing its ban on cryptocurrencies, although advertisers will have to be approved first, while ICO will be blocked. Interested advertisers must complete the application containing information about the licenses and information whether their cryptocurrency is publicly available.

The original ban on Facebook appeared at a time when cryptocurrencies, such as Bitcoin, were flourishing, and largely unregulated space gave rise to loud frauds and with the help of influential people from the financial world and banks, crypto-currencies were slandered, also using the media. A similar ban was also introduced by Google, Twitter, and Snapchat, and Bitcoin's price dropped from $ 20,000 to $ 6,000 in five months. Wondering coincidence?

The first Facebook policy aimed at all "financial products and services often associated with misleading or fraudulent promotional practices", even stopped legitimate companies from buying advertising. Now, however, interested advertisers can fill out an application containing information about licensing and whether their currency is publicly available to help Facebook determine their eligibility.

"Considering these limitations, not everyone who wants to advertise will be able to do so" - writes Robert Leathern in the product manager on Facebook and adds: "but we will listen to feedback, we will check how this policy works and we continue to study this technology so that we can revise it over time".

In May, Facebook created a new experimental Blockchain group, headed by former Messenger Manager David Marcus, to focus on technology that is the foundation of cryptocurrencies.

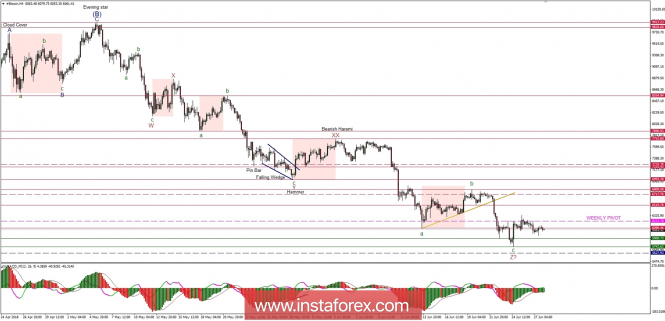

Let's now take a look at the Bitcoin technical picture at the H4 time frame. A lack of volatility is clear at the current market as the price is hovering just below the weekly pivot at the level of $6,223. This is somehow a good news for all of the bulls as the price is consolidating the gains. The bullish divergence helps to lift the price a little, but the key resistance at the level of $6,519 is still not violated. The immediate support is seen at the level of $5,900 and then at the swing low at $5,742.