Today, the European Central Bank is taking the "baton" of important decisions on monetary policy after the outcome of the Fed meeting. What is the "threat" to the euro and what will be its immediate prospects?

However before we answer these burning questions, it is worth summarizing the Fed meeting on monetary policy. As expected, the American regulator expectedly raised the key interest rate by 0.25%, to 2.00%, and now its rate ranges from 1.75% to 2.00%. In addition, J. Powell, the head of the US Central Bank, said that another increase in interest rates is expected this year in addition to the expected three. The resolution of the bank, as well as in the speech of its leader, was to be optimistic about the prospects for the growth of the US economy, as well as further lowering of the unemployment rate and a gradual rise in inflationary pressures. In addition, it was reported that the process of gradual raising of interest rates will continue. Their probable average and maximum levels for the next two years have been determined.

The foreign exchange market first reacted with purchases of the US dollar to publish the final resolution of the Federal Reserve, then, as it carefully read into its essence, and then listened to Powell's words, moved on to selling the dollar. The main reason for this is, on one hand, the expected outcome of the meeting, and on the other, the understanding that the process of tightening monetary policy will proceed smoothly, which can be leveled by the beginning of similar processes in other securities of the Central Bank that are traded against the dollar at the Big Forex.

In this row, the outcome of the ECB meeting on monetary policy, which will become known this afternoon, will be extremely important. Markets will wait from the European regulator for another reduction in the volume of asset purchase and a signal that by October this process will be fully completed. Earlier, the ECB has repeatedly informed about this, therefore, if today it is not specific in its plans, it will float. It can have a disappointing effect and lead to a local depreciation of the euro, primarily in relation to the US dollar . Such a possibility is likely since the regulator may wish to take a wait-and-see attitude until the next July meeting in order to be convinced of the factor of maintaining the growth of the European economy and the presence of an increase in inflationary pressures.

Forecast of the day:

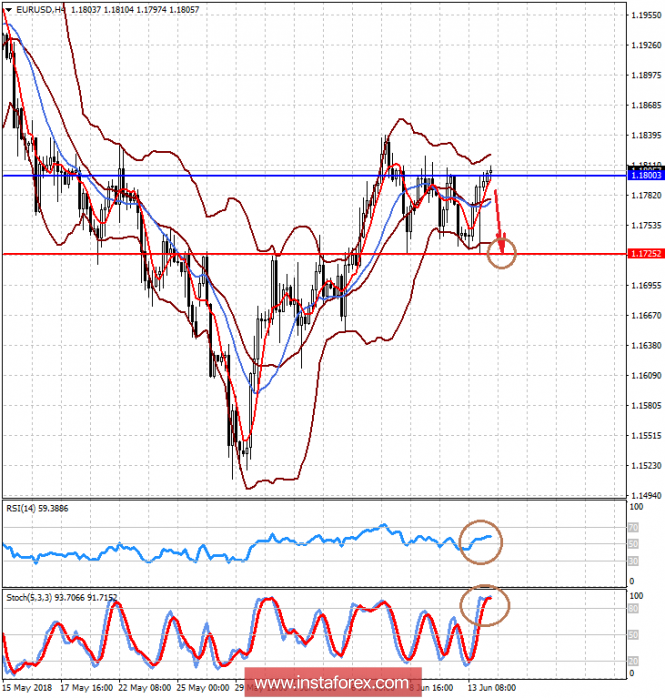

The EURUSD pair is consolidating in the "outset" pending the outcome of the ECB meeting. If the bank's position on the prospects for the termination of incentive measures is vague, it could lead to a drop in price to 1.1725 after overcoming the level of 1.1800.

The USDJPY pair remains in the short-term uptrend but it demonstrates a local reversal down in the wake of the weakness of the dollar following the Fed's meeting on monetary policy. From a technical point of view, it can continue to decline to 109.20 after falling below the 110.00 mark.