Dear colleagues.

For the EUR / USD pair, the development of the upward structure is expected after the breakdown of 1.1695. For the GBP / USD pair, the continuation of the movement towards the bottom is expected after the breakdown of 1.3195. For the USD / CHF pair, we expanded the potential for the downward structure from May 29 to the level of 0.9754. For the USD / JPY pair, the price is in correction from the downward structure on May 21. For the EUR / JPY pair, the development of the upward structure of May 29 is expected after the breakdown of 128.16. For the GBP / JPY pair, the level of 146.27 is the key support for the downward cycle. The development of the main trend is expected after the breakdown of 142.73.

Forecast for June 1:

Analytical review of currency pairs in the scale of H1:

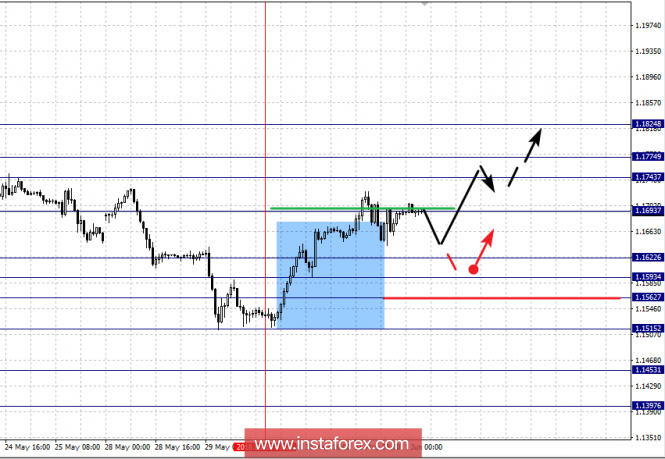

For the EUR / USD pair, the key levels on the scale of H1 are: 1.1824, 1.1774, 1.1743, 1.1693, 1.1622, 1.1593, 1.1562, 1.1515, 1.1453 and 1.1397. Here, we follow the upward structure of May 30. The continuation of the development of the upward trend is expected after the breakdown of 1.1693. In this case, the target is 1.1743. In the area of 1.1743 - 1.1774 is the consolidation of the price. For the potential value for the top, consider the level of 1.1824. Upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possible in the area of 1.1622-1.1593. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.1562. This level is the key support for the upward structure from May 30. Its breakdown will lead to the development of the a downward structure. In this case, the first goal is 1.1515.

The main trend is the formation of the potential for the top of May 30.

Trading recommendations:

Buy: 1.1695 Take profit: 1.1742

Buy 1.1775 Take profit: 1.1822

Sell: 1.1622 Take profit: 1.1593

Sell: 1.1560 Take profit: 1.1515

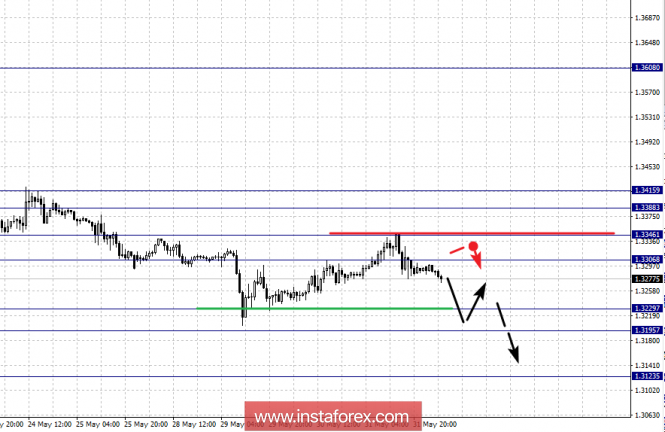

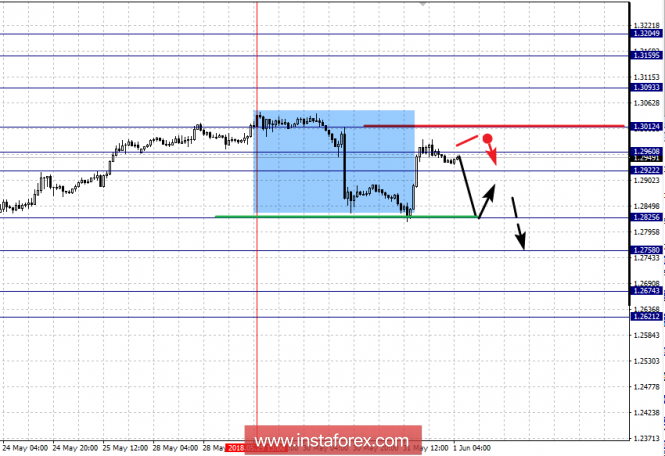

For the GBP / USD pair, the key levels on the scale of H1 are 1.3415, 1.3388, 1.3346, 1.3306, 1.3229, 1.3195 and 1.3123. Here, we continue to follow the downward structure from May 14. The continuation of the movement towards the bottom is expected after passing the price of the noise range at 1.3229 - 1.3195. In this case, the target is 1.3123. Upon reaching this level, we expect a rollback to the top.

Short-term upward movement is possible in the area of 1.3306 - 1.3346. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.3388. The level of 1.3415 is the potential for the top. Before reaching this level, we expect the initial conditions for the upward cycle to be formalized.

The main trend is the downward cycle from May 14.

Trading recommendations:

Buy: 1.3306 Take profit: 1.3344

Buy: 1.3348 Take profit: 1.3388

Sell: 1.3227 Take profit: 1.3196

Sell: 1.3193 Take profit: 1.3125

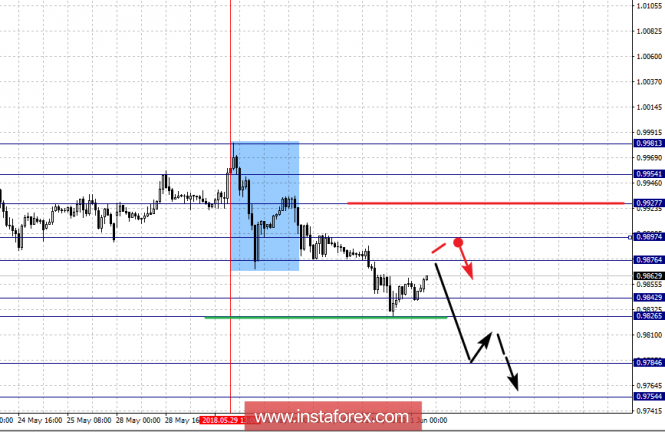

For the USD / CHF pair, the key levels on the scale of H1 are: 0.9954, 0.9927, 0.9897, 0.9876, 0.9842, 0.9826, 0.9784 and 0.9754. Here, the subsequent development of the downward structure from May 29 is expected after passing the price of the noise range of 0.9842 - 0.9826. In this case, the target is 0.9784. For the potential value for the bottom, consider the level of 0.9754. Upon reaching this level, we expect a pullback to the top.

Short-term upward trend is possible in the area of 0.9876 - 0.9897. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.9927. This level is the key support for the downward structure. Its breakdown will allow us to count on the movement towards the level of 0.9954.

The main trend is a local downward structure from May 29.

Trading recommendations:

Buy: 0.9876 Take profit: 0.9895

Buy: 0.9898 Take profit: 0.9925

Sell: 0.9826 Take profit: 0.9786

Sell: 0.9782 Take profit: 0.9755

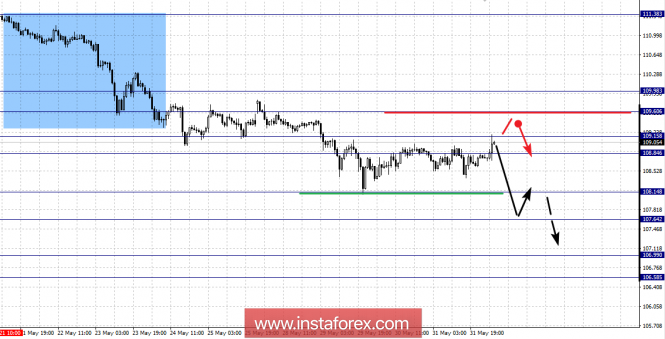

For the USD / JPY pair, the key levels on a scale are: 109.98, 109.60, 109.15, 108.84, 108.14, 107.64, 106.99 and 106.58. Here, we follow the downward structure of May 21. The continuation of the movement towards the bottom is expected after the breakdown of the level of 108.14. In this case, the target is 107.64. Near this level is the consolidation of the price. The breakdown of 107.62 must be accompanied by a pronounced movement towards the level of 106.99. For the potential value for the bottom, consider the level of 106.58. Upon reaching this level, we expect a rollback to the top.

Short-term upward movement is possible in the area of 108.84 - 109.15. The breakdown of the last value will lead to in-depth correction. Here, the target is 109.60. The level of 109.98 is a potential value for the top. Before reaching this level, we expect the initial conditions for the upward cycle to be formalized.

The main trend is the downward structure of May 21.

Trading recommendations:

Buy: 108.84 Take profit: 109.12

Buy: 109.17 Take profit: 109.60

Sell: 108.12 Take profit: 107.66

Sell: 107.62 Take profit: 107.00

For the CAD / USD pair, the key levels on the H1 scale are: 1.3204, 1.3159, 1.3093, 1.3012, 1.2960, 1.2922, 1.2825, 1.2758, 1.2674 and 1.2621. Here, we follow the upward structure of May 22. At the moment, the price is in deep correction from this structure and forms the potential for the bottom of May 29. Consolidated movement is expected in the area of 1.2922 - 1.2960. The breakdown of the last value will lead to a movement towards the level of 1.3012. This level is the key resistance for the subsequent development of the upward trend.

The development of a downward trend from May 29 is expected after the breakdown of 1.2825. Here, the first target is 1.2758. Near this level is the consolidation of the price. The breakdown of 1.2755 should be accompanied by a pronounced movement towards the potential value of - 1.2674.

The main trend is the rising trend from May 22, a deep correction.

Trading recommendations:

Buy: 1.2960 Take profit: 1.3012

Buy: 1.3014 Take profit: 1.3090

Sell: 1.2825 Take profit: 1.2760

Sell: 1.2755 Take profit: 1.2680

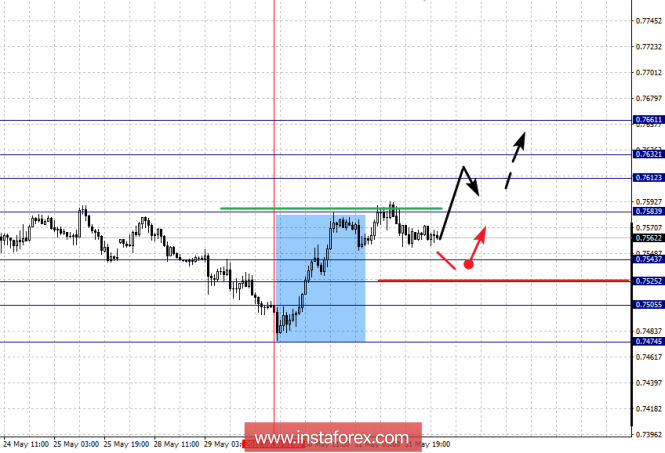

For the AUD / USD pair, the key levels on the scale of H1 are: 0.7661, 0.7632, 0.7612, 0.7583, 0.7543, 0.7525, 0.7505 and 0.7474. Here,the price forms the potential for the upward movement of May 30. The continuation of the movement towards the top is expected after the breakdown of 0.7583. In this case, the target is 0.7612. In the area of 0.7612 - 0.7632 is the consolidation of the price. For the potential value for the top, consider the level of 0.7661. Upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possible in the area of 0.7543 - 0.7525. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.7505. This level is the key support for the upward structure. Its breakdown will lead to a downward movement. In this case, the target is 0.7474.

The main trend is the formation of the potential for the top of May 30.

Trading recommendations:

Buy: 0.7583 Take profit: 0.7612

Buy: 0.7632 Take profit: 0.7660

Sell: 0.7541 Take profit: 0.7526

Sell: 0.7505 Take profit: 0.7478

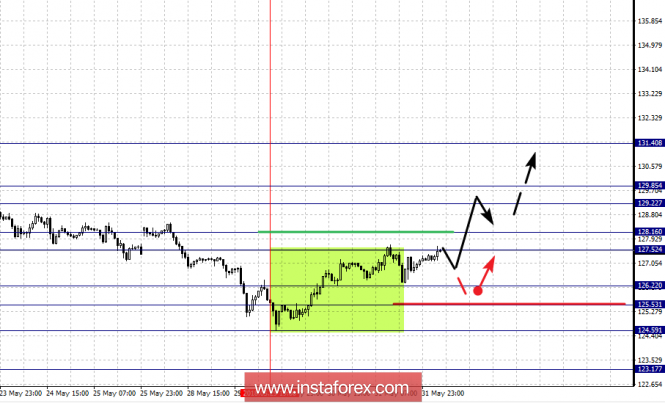

For the EUR / JPY pair, the key levels on the scale of H1 are: 131.40, 129.85, 129.22, 128.16, 127.52, 126.22, 125.53, 124.59 and 123.17. Here, we follow the downward structure from May 22. At the moment, the price is in correction and forms a small potential for the top. The continuation of the movement towards the top is expected after passing the price of the noise range of 127.52 - 128.16. In this case, the target is 129.22. In the area of 129.22 - 129.85 is the consolidation of the price. For the potential value for the top, consider the level of 131.40. Upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possible in the area of 126.22 - 125.53, hence the probability of a turn to the top is high. The breakdown of the level of 125.50 will lead to the development of a downward structure. Here, the first target is 124.59. For the potential value for the bottom, consider the level of 123.17.

The main trend is the downward structure from May 22, the correction stage.

Trading recommendations:

Buy: 128.16 Take profit: 129.20

Buy: 129.85 Take profit: 131.40

Sell: 126.20 Take profit: 125.55

Sell: 125.50 Take profit: 124.60

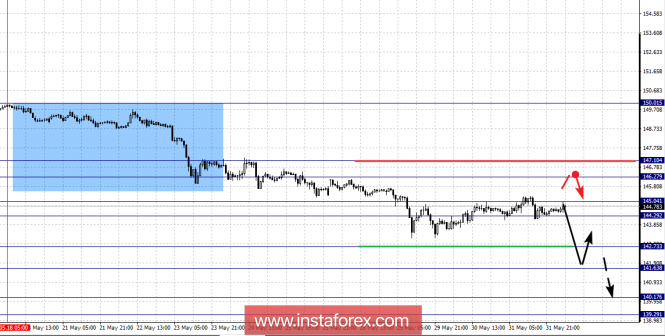

For the GBP / JPY pair, the key levels on the scale of H1 are: 147.10, 146.27, 145.04, 144.29, 142.73, 141.63, 140.17 and 139.29. Here, we follow the downward structure of May 18. The continuation of the movement towards the bottom is expected after the breakdown of the level of 142.73. In this case, the target is 141.63. Near this level is the consolidation of the price. The break of level 141.60 should be accompanied by a pronounced movement towards the level of 140.17, the potential value for the bottom, consider the level of 139.29. Upon reaching this level, we expect a pullback to the top.

Short-term upward movement is possible in the area of 144.29 - 145.04. The breakdown of the last value will lead to in-depth correction. Here, the target is 146.27. The range of 146.27 - 147.10 is the key support for the downward structure, before it we expect the initial conditions for the upward cycle to be formalized.

The main trend is the downward structure of May 18.

Trading recommendations:

Buy: 144.30 Take profit: 145.02

Buy: 145.08 Take profit: 146.25

Sell: 142.70 Take profit: 141.65

Sell: 141.60 Take profit: 140.20

The material has been provided by InstaForex Company - www.instaforex.com