Forecast for June 29:

Analytical review of currency pairs in the H1 scale:

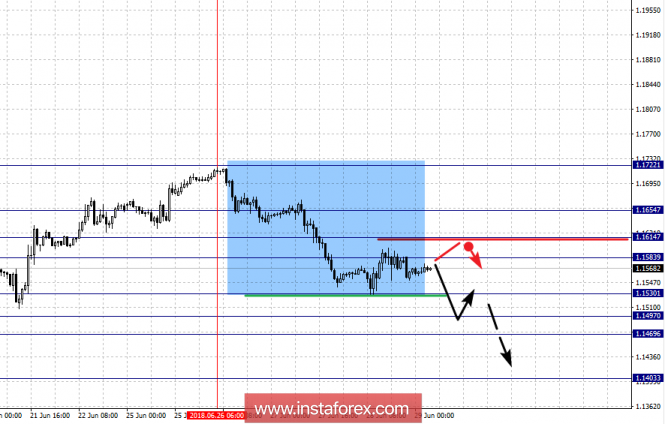

For the Euro/Dollar pair, the key levels on the H1 scale are: 1.1654, 1.1614, 1.1583, 1.1530, 1.1497, 1.1469 and 1.1403. Here, a potential local downward movement of June 26 is being formed. The downward movement is expected to continue after the breakdown of 1.1530, in this case the target is 1.1497 near the consolidation level. Passage at the price of the noise range 1.1497 - 1.1469 should be accompanied by the determined downward movement with the target at 1.1403, and we expect a rollback to the top from this level.

Short-term upward movement is possible in the corridor 1.1583 - 1.1614, and the breakdown of the last value will lead to an in-depth correction with the target at 1.1654, an area which is the key support for the downward structure.

The main trend is the formation of a downward structure from June 26.

Trading recommendations:

Buy: 1.1585 Take profit: 1.1612

Buy 1.1616 Take profit: 1.1652

Sell: 1.1530 Take profit: 1.1500

Sell: 1.1467 Take profit: 1.1405

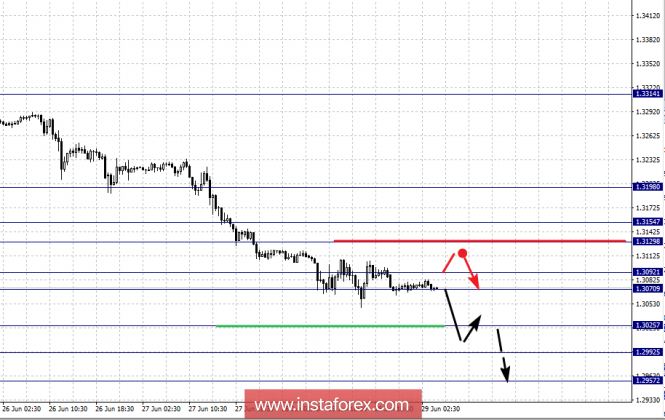

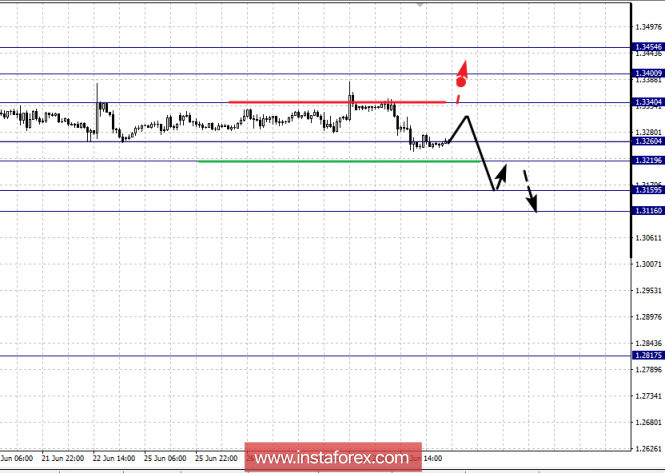

For the Pound/Dollar pair, the key levels on the H1 scale are 1.3198, 1.3154, 1.3129, 1.3092, 1.3070, 1.3025, 1.2992 and 1.2957. Here, we have expanded the potential downward movement to the level of 1.2957. Continued downward movement is expected after passing through the noise range of 1.3092 - 1.3070. In this case the target is 1.3025, in the corridor 1.3025 - 1.2992 short-term downward movement. The potential value for the bottom is the 1.2957 level, and we expect a rollback to the top upon reaching this zone.

Short-term upward movement is possible in the corridor 1.3129 - 1.3154, while the breakdown of the last value will lead to an in-depth correction with the target at 1.3198, an area which is the key support for the bottom.

The main trend is the downward cycle from June 22nd to the M30 scale.

Trading recommendations:

Buy: 1.3130 Take profit: 1.3152

Buy: 1.3156 Take profit: 1.3196

Sell: 1.3070 Take profit: 1.3027

Sell: 1.3021 Take profit: 1.2995

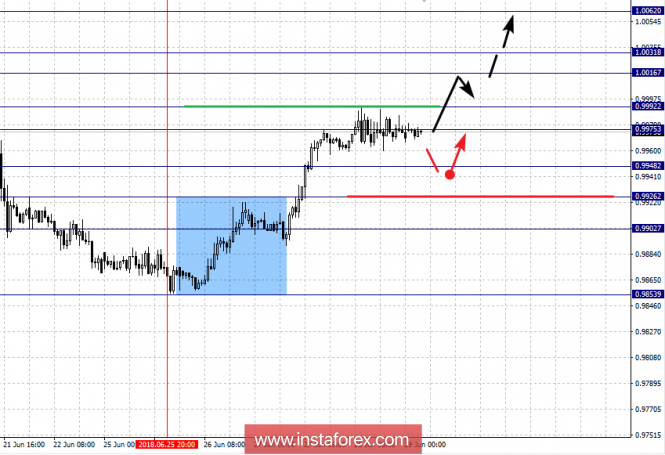

For the Dollar/Franc pair, the key levels on the H1 scale are: 1.0062, 1.0031, 1.0016, 0.9992, 0.9975, 0.9948, 0.9926 and 0.9902. Here, we follow the formation of the upward structure of June 25. The continuation of the upward movement is expected after the passage at the price of the noise range 0.9975 - 0.9992. In this case, the target is 1.0016 within the corridor 1.0016 - 1.0031 consolidation. The potential value for the top is the level of 1.0062 and we expect a downward pullback.

Short-term downward movement is possible in the corridor 0.9948 - 0.9926, while the breakdown of the last value will lead to an in-depth correction with the target at 0.9902, which is the key support for the upward structure of June 25.

The main trend is the formation of the upward structure of June 25.

Trading recommendations:

Buy: 0.9975 Take profit: 0.9990

Buy: 0.9994 Take profit: 1.0014

Sell: 0.9946 Take profit: 0.9928

Sell: 0.9624 Take profit: 0.9905

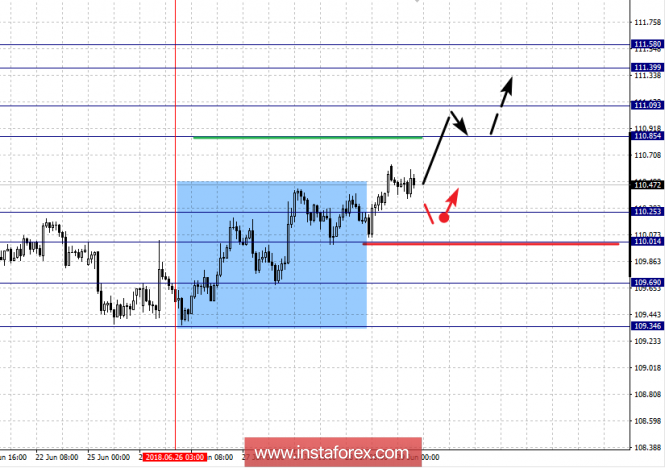

For the Dollar/Yen pair, the key levels on the H1 scale are: 111.58, 111.39, 111.09, 110.85, 110.25, 110.01 and 109.69. Here, we determined the following targets from the upward structure on June 26. The upward movement is expected to continue after the breakdown of 110.85, and in this case the target is 111.09 near this level is consolidation. The level 111.10 break should be accompanied by a determined upward movement and the target is the 111.39. The potential value for the top is the level of 111.58 and we expect consolidation and a downward pullback.

Short-term downward movement is possible in the corridor 110.25 - 110.01, while the breakdown of the last value will lead to an in-depth correction with the target at 109.69, which is the key support for the top.

The main trend: the upward structure of June 26.

Trading recommendations:

Buy: 110.85 Take profit: 111.06

Buy: 111.12 Take profit: 111.35

Sell: 110.25 Take profit: 110.05

Sell: 110.00 Take profit: 110.70

For the Canadian Dollar/US Dollar pair, the key levels on the H1 scale are: 1.3454, 1.3400, 1.3340, 1.3260, 1.3219, 1.3159 and 1.3116. Here, we follow the local upward structure of May 31. The upward movement is expected to continue after the breakdown of 1.3340 and in this case the target is 1.3400 near consolidation level. The potential value for the top is the level of 1.3454 and we expect a downward pullback from this area.

Short-term downward movement is possible in the corridor 1.3260 - 1.3219, while the breakdown of the last value will lead to an in-depth correction with the target at 1.3160. The range 1.3159 - 1.3116 is the key support for the top.

The main trend is the upward structure of May 31.

Trading recommendations:

Buy: 1.3340 Take profit: 1.3400

Buy: 1.3402 Take profit: 1.3452

Sell: 1.3260 Take profit: 1.3220

Sell: 1.3216 Take profit: 1.3160

For the Australian Dollar/US Dollar pair, the key levels on the H1 scale are: 0.7569, 0.7512, 0.7440, 0.7400, 0.7322, 0.7262 and 0.7216. Here, we continue to follow the downward cycle from June 6. The downward movement is expected after the breakdown of the 0.7322 level, with the target at 0.7262, in the corridor 0.7262 - 0.7216 consolidation and we expect a major upward reversal from that point.

Consolidated trend is possible in the corridor 0.7400 - 0.7440, while the breakdown of the last value will lead to an in-depth correction with the target at 0.7512. We expect initial conditions for the upward cycle to reach the level of 0.7569.

The main trend is the downward cycle from June 6, the correction stage.

Trading recommendations:

Buy: 0.7442 Take profit: 0.7510

Buy: 0.7514 Take profit: 0.7566

Sell: 0.7320 Take profit: 0.7264

Sell: 0.7260 Take profit: 0.7218

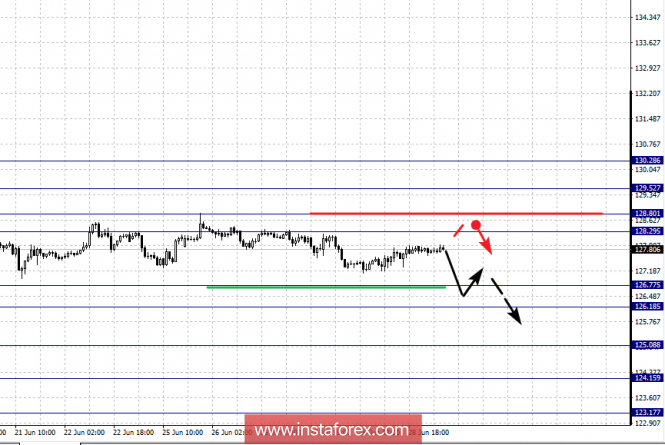

For the EUR/JPY pair, the key levels on the H1 scale of are: 129.52, 128.80, 127.80, 126.77, 126.18, 125.08 and 124.15. Here, the situation has entered the equilibrium state. Short-term downward movement is expected in the corridor 126.77 - 126.18, while breakdown of the last value will lead to the 125.08 near consolidation level. Potential value for the bottom is level 124.15, from which we expect an upward rollback.

Short-term upward movement is possible in the corridor 127.80 - 128.29, while breakdown of the last value will lead to an in-depth correction with the target at 128.80, this level is the key support for the downward structure from June 13. Its breakdown is expected to develop an upward structure, and in this case the potential target - 129.52.

The main trend is the equilibrium state.

Trading recommendations:

Buy: 127.80 Take profit: 128.25

Buy: 128.32 Take profit: 128.80

Sell: 126.75 Take profit: 126.20

Sell: 126.14 Take profit: 125.15

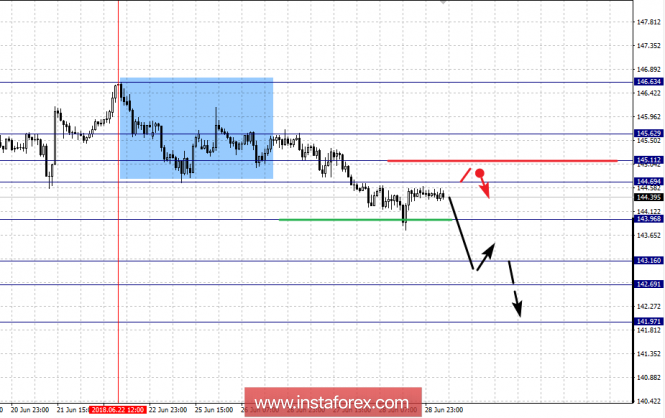

For the Pound/Yen pair, the key levels on the H1 scale are: 145.62, 145.11, 144.69, 143.96, 143.16, 142.69 and 141.97. Here, we determined the following targets for the downward movement from the local structure on June 22. The downward movement is expected to continue after the breakdown of 143.96, and in this case the target is 143.16, in the corridor 143.16 - 142.69 consolidation. The potential value for the bottom is the level of 141.97, which we expect a rollback to the top upon reaching that point.

Short-term uptrend is possible in the corridor 144.69 - 145.11, while breakdown of the last value will lead to an in-depth correction with the target at 145.62 level, which is the key support for the downward structure from June 22.

The main trend is the local structure for the bottom of June 22.

Trading recommendations:

Buy: 144.70 Take profit: 145.10

Buy: 145.20 Take profit: 145.60

Sell: 143.95 Take profit: 143.25

Sell: 143.15 Take profit: 142.75

* The presented market analysis is informative and does not constitute a guide to the transaction.

The material has been provided by InstaForex Company - www.instaforex.com