Overview:

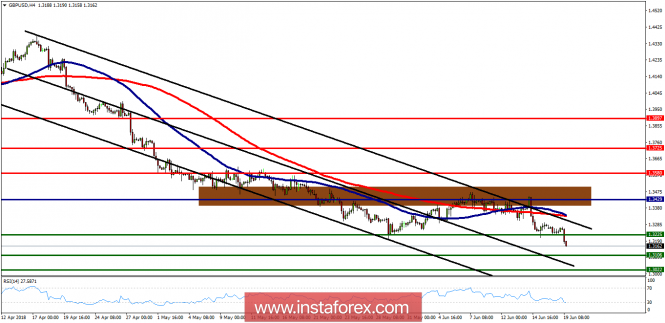

This week, the GBP/USD pair opened below the weekly pivot point (1.3429). It continued to move downwards from the level of 1.3429 to the bottom around 1.3225. Today, the first resistance level is seen at 1.3429 followed by 1.3580, while daily support 1 is seen at 1.3225.

Furthermore, the moving average (100) starts signaling a downward trend; therefore, the market is indicating a bearish opportunity below 1.3225. So it will be good to sell at 1.3250 with the first target of 1.3200. It will also call for a downtrend in order to continue towards 1.3106. The strong daily support is seen at the 1.3106 level, which represents the double bottom on the H4 chart.

According to the previous events, we expect the GBP/USD pair to trade between 1.3250 and 1.3106 in coming hours. The price area of 1.3300 remains a significant resistance zone. Thus, the trend is still bearish as long as the levels of 1.3300/1.3429 are not broken. On the contrary, in case a reversal takes place and the GBP/USD pair breaks through the resistance level of 1.3429, then a stop loss should be placed at 01.3475.

The material has been provided by InstaForex Company - www.instaforex.com