The softer than expected statements of European Central Bank President Mario Draghi hurt the buyers of the European currency, who were counting on the formation of a new upward medium-term trend.

As you can see from yesterday's report, the ECB does not seek to tighten the policy, and even more so a higher rate of the European currency, which could harm the recovery of the eurozone economy after the disastrous 1st quarter of this year.

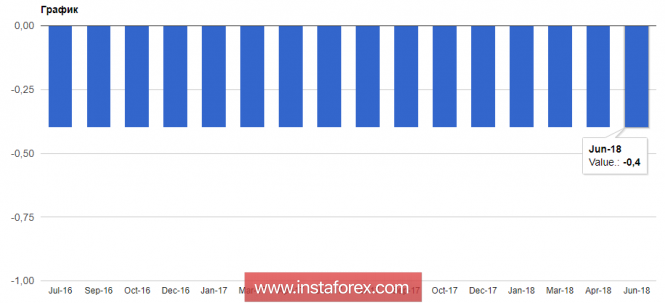

Yesterday the Governing Council decided to keep the deposit rate at a negative level of -0.4% until the summer of 2019, which was obviously a surprise for investors and traders who expect an earlier tightening of monetary policy after the completion of the asset purchase program in December this year.

Let me remind you that the ECB will continue to carry out net purchases under the asset repurchase program for 30 billion euros a month until the end of September this year. After September, net purchases of assets will be reduced to €15 billion by the end of December 2018. By early January 2019, it is planned to fully complete the asset buy-back program.

The ECB also tries to prevent undesirable tightening of financial conditions, so as not to harm the economy. This is also reflected in the revision of forecasts for GDP growth.

Judging by the report of the ECB economists, the forecast for GDP growth for 2018 was revised to 2.1% from 2.4%. The expectations of economic growth for 2019 and 2020 remained unchanged. This suggests that the first quarter of this year, which was a failure, had only a temporary pressure on the economy.

As for inflation, which the European regulator worries about, ECB economists have raised their forecasts for this year to 1.7% against 1.4%. Also, forecasts were raised for 2019. The revision was due to the recent rise in oil prices.

Despite all the statements in favor of changing the course of monetary policy in the foreseeable future, the president of the ECB focused on trade relations, which carry a number of risks because of the policy of US President Donald Trump.

Draghi also made it clear that if necessary, the incentive program will be resumed at any time.

As for the technical picture of the EURUSD pair, the sharp collapse of the euro led to the demolition of a number of major support levels. The stop has so far happened in the area of support 1.1560. The break and consolidation below this range opens up new monthly lows around 1.1490 and 1.1410. If we talk about the short-term upward correction of the euro, then it will be limited to the nearest resistance in the area of 1.1610 and 1.1650.

The material has been provided by InstaForex Company - www.instaforex.com