EUR / USD

The economic indicators that emerged on Tuesday were unequivocally on the side of the dollar, but the media reported that the adjusted monetary policy will be announced at the ECB meeting on June 14. With this, single European currency rose higher and close the day at 20 points. Of course, the reaction of the market is strange and mostly, no one doubts this forthcoming statement. But the markets should take into account that the economic prospects of the eurozone will deteriorate sharply as they expected this June. First of all, the US pressure on the EU led by trade wars. Regardless of what resolution the EU has come up with, it will surely weaken the region, since the EU-US trade turnover is positive for the EU (as for China), which will strike the first stronger blow.

The final estimate for May business activity indicator in the service sector of the euro area is expected to be unchanged at 53.9 but was lowered to 53.8. Retail sales in the euro area in April increased by only 0.1% against expectations of growth of 0.5%. In the United States, the non-manufacturing sector activity (ISM Non-Manufacturing PMI) in May showed an increase from 56.8 to 58.6, with the expectation of a smaller increase to 57.9.

Today, the US trade balance for April will be released. The forecast is -50.0 billion dollars against -49.0 billion in March. This is worse than in the previous 4 years for a given month, so even a slightly better indicator can bring optimism to the market.

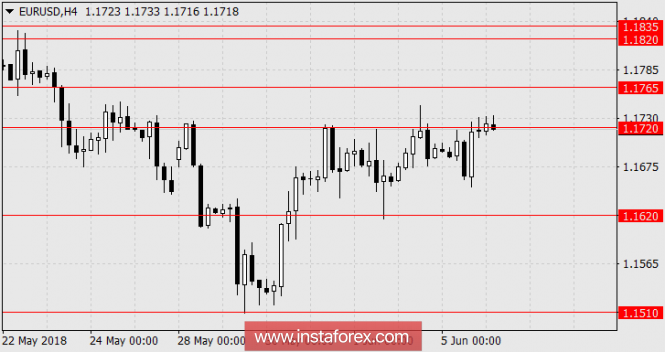

We are waiting for the euro to return to 1.1620 and further to 1.1510.

* The presented market analysis is informative and does not constitute a guide to the transaction.

The material has been provided by InstaForex Company - www.instaforex.com