The US dollar opens a new week with strong growth, working out not only the growing gap in the monetary policies of the ECB and the Fed, but also preparing for the beginning of a full-scale trade war, "the US against all", the threat of which is currently higher than ever.

We have repeatedly noted that Trump's trade wars are absolutely inevitable under current conditions, despite victorious reports about the strength of the US economy and on improving the macroeconomic forecasts of the Fed, which justifies the acceleration of the pace of normalization of monetary policy.

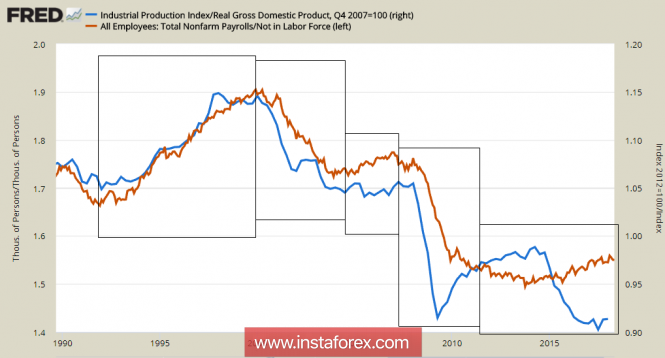

The chart below shows two key patterns describing the economic condition of the United States. One of them reflects the share of industrial production in the GDP structure and it shows that the state of the real economy is not just bad, it is catastrophic. The growth of the real sector came to a halt in 2000, shortly before assets were rushed into the growing bubble of "house committees", and at the moment there are no signs of a correction of the situation. In May 2018, the volume of industrial production fell again by 0.1%, and therefore the entire growth of GDP, referred to by the Federal Reserve, consists exclusively of the growth of the services sector.

The second criterion is the ratio of the number of new jobs created by the US economy to the number of citizens falling out of the labor force. At the moment, unemployment in the US is only 3.8%, the Fed expects a decline in the coming year to 3.6%, which actually meets the criteria for full employment. However, the real ratio of workers to non workers is worse than before the 2008 crisis and much worse than in 2000, remaining at a historically low level. It's not about demographics, it's a matter of the crafty statistics, which allows us to take out of the workforce a significant part of the working population, not only unemployed, but also desperate to find it.

To date, the real sector is not able to create jobs, and the US economy will not be able to maintain a dominant position in the world without decisive actions to change the structure of GDP; a post-industrial society does not withstand price competition with Asian countries, and an attempt to close its market from cheap imports is an inevitable step in the struggle for a new industrialization of the United States. Trump does what he can to save the American economy, and therefore his actions are consistently logical and can not be canceled. Trade partners of the United States need to leave the illusion that they can bargain for themselves any privileged conditions - this is simply impossible.

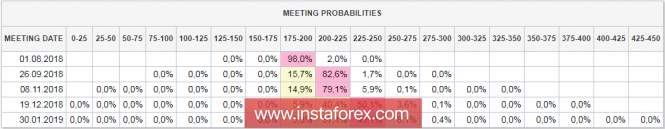

In this light, the Fed's policy is clearly aimed at strengthening the dollar. In addition to the fact that the Fed is tightening the rate of growth and reduces the balance sheet, it is engaged in another process, which does not focus attention - an attempt to gently get rid of the excess reserves of banks. At the last meeting, the Fed raised the rate for excess reserves by 0.2% instead of 0.25%, thereby reducing the profitability of banks when placing funds on the Fed's correspondent accounts, and most likely will reduce the profitability of the placement further. Thus, the Fed intends to force banks to assume part of the responsibility for financing the government's debt, after all, someone has to buy out the Treasuries, if the Fed itself does not intend to do so?

The dollar will dominate the markets in the coming week, confidence in a fourth rate hike this year is growing, the spread of yields will also grow in favor of US assets.

Important macroeconomic data is not expected at the beginning of the week, the publication of preliminary PMI Markit data for June is of interest, however this will happen only on Friday, and therefore there are no economic reasons for changing sentiments. Markets will be prepared for the beginning of trade wars in which, in addition to the United States and China, the EU, Canada and Mexico - all major US trading partners - will take part. Tightening the Fed's policy will lead to a further withdrawal of the dollar from emerging markets, financial flows will objectively contribute to the growth of demand for the dollar, and it is unlikely that something will be able to prevent it from strengthening.

Markets will listen carefully to the comments of a number of FOMC members on Monday and Tuesday, as well as to the discussion of a number of Central Bank heads at the ECB forum opening today.

The material has been provided by InstaForex Company - www.instaforex.com