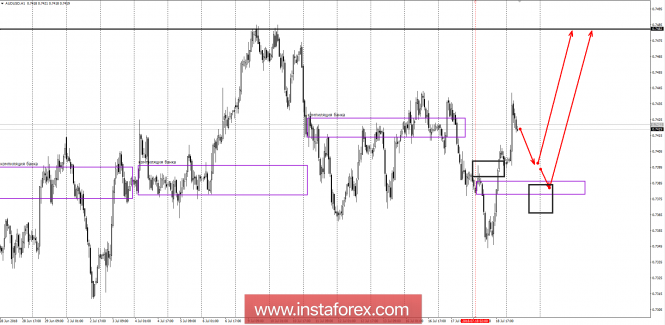

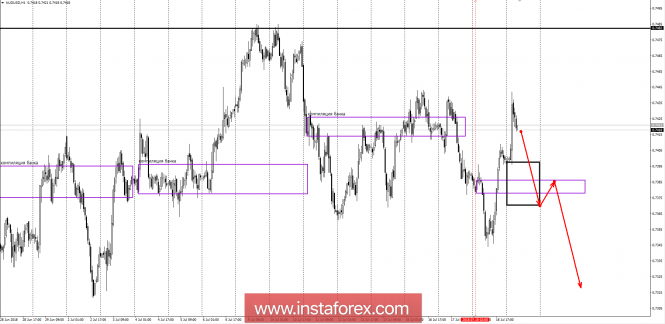

Yesterday, a new zone of bank compilation was formed. The movement relative to it indicates an upward priority in the second half of the week. The first goal of growth will be the July maximum.

Yesterday's close of the American session above the zone of bank compilation indicates the need to find favorable prices for the purchase. The first goal of fixing will be the July maximum of 0.7482, where the fate of the upward movement will be determined. Advantageous purchase prices are read from the level of yesterday's America's close. The retest of the compilation zone will allow you to get transactions with a risk-to-profit ratio of 1 to 5, which at a distance will give a significant advantage to your side.

It is important to note that the pair is traded within the medium-term accumulation zone, and the banking compilation zones are formed in the same range. This allows you to record profits on the boundaries of the zone and look for transactions in the direction of opposite boundaries.

To cancel the upward movement, the upturn of yesterday's growth will be required, which will lead to the closure of today's American session below the zone of bank compilation. This model will require immediate closure of purchases and the search for favorable prices for the sale of the Australian dollar. The probability of implementing the downward model is 30%, which makes sales from current grades unprofitable. This must be taken into account when building a daily trading plan.

The daily short-term fault is the daytime control zone. The zone formed by important data from the futures market, which change several times a year.

The weekly short-term fault is the weekly control zone. The zone formed by important futures market marks, which change several times a year.

The monthly short-term fault is the monthly control zone. The zone, which is a reflection of the average volatility over the past year.

The material has been provided by InstaForex Company - www.instaforex.com