GBP/USD

On Friday, the pound added 131 points on the release of good economic performance. UK GDP in the final assessment for the 1st quarter was 0.2% vs. 0.1% in the previous estimate and the forecast was unchanged. The balance of payments for the same period improved from -19.5 billion pounds (revised from -18.4 billion) to -17.7 billion pounds. The forecast was -18.0 billion pounds. The number of issued permits for mortgage lending increased from 63, 000 in May, and the revised ones from 62, 000 to 65, 000, while 62, 000 were expected. The net volume of new loans granted to individuals declined slightly (from 5.6 billion pounds to 5.3 billion pounds), but the forecast assumed an even greater decline to 5.2 billion pounds.

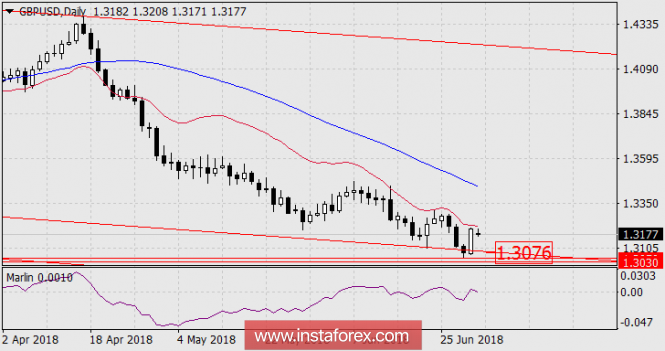

Technically, the price is still below the carrying price. A sign of its overcoming is the increasing signal line of the Marlin oscillator since may and its transition to the zone of positive values. But the stretch of the process also warns of the trend's exhaustion. With a slight decrease in the price, this line can again return to the negative territory.

On the four-hour chart, the price was also withheld by the balance sheet. Bala crossed the Krusenstern line , but in the current context, this output can be interpreted as false. Also, the Marlin indicator line can easily return to the drop zone.

The price index may be pushed up by today's PMI (manufacturing PMI) index - the forecast for June is 54.1 versus 54.4 in May. But the main concern of investors is the extremely exacerbated problem of Brexit. At last week's EU summit it was decided that if Britain drags out decisions on contentious issues, the country may remain without a trade deal. Today new negotiations begin.

We are waiting for the price to support the trend line in the area of 1.3076.

The material has been provided by InstaForex Company - www.instaforex.com