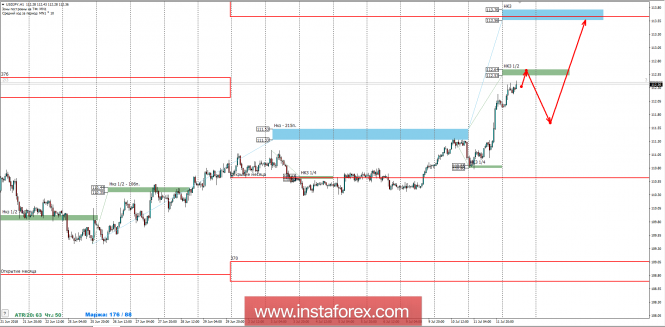

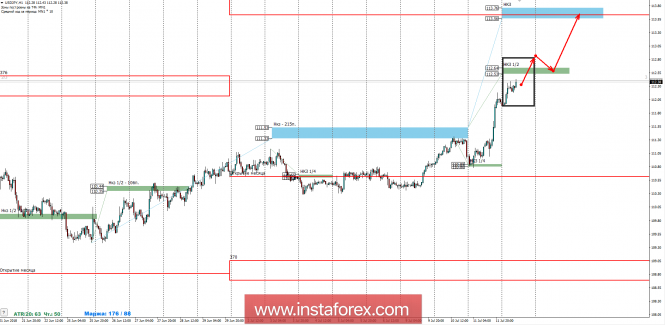

The upward movement remains a medium-term impulse, which implies the search for favorable prices for the purchase of the instrument and the retention of part of the previous transactions. The closest growth target remains the NCP 1/2 112.64-112.53.

Yesterday's test of the NCP 1/4 110.85-110.80 allowed to open purchases. The first purpose of fixing a long position is the NCP 1/2 112.64-112.53. The second part of the position should be transferred to lossless and left in case of further growth to the weekly short-term fault of 113.76-113.56, which is within the monthly short-term fault of July. The test of the nearest resistance can lead to an increase in supply and the formation of a correctional model. This will once again buy the instrument in case of a fall to one of the control zones formed from the July maximum.

The upward movement is so strong that it can break down and anchor above the NCP 1/2 without forming a deep correction. This model is not suitable for purchases, as it will have to be bought at unprofitable prices, and the risk-to-profit ratio will be unprofitable.

To obtain favorable prices for the purchase, a reduction in the exchange rate is required, so it is necessary to stop the course with the formation of the supply level. Sales to be considered from the NCP 1/2 112.64-112.53 is not recommended, however use the drop is necessary for purchases at more favorable prices. It is pointless to consider the option of reversal of the medium-term impulse, as conditions for this have not been created.

The daily short-term fault is the daytime control zone. The zone formed by important data from the futures market, which change several times a year.

The weekly short-term fault is the weekly control zone. The zone formed by important futures market marks, which change several times a year.

The monthly short-term fault is the monthly control zone. The zone, which is a reflection of the average volatility over the past year.

The material has been provided by InstaForex Company - www.instaforex.com