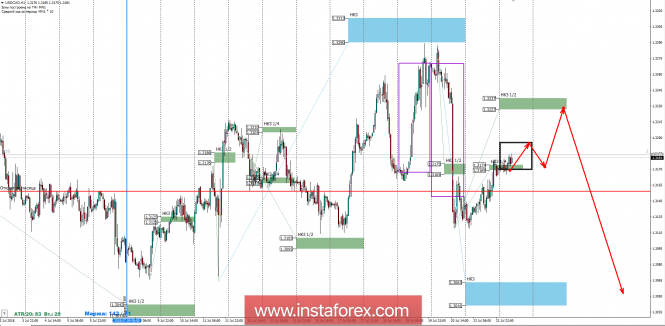

The situation of the pair is quite complicated due to the availability of supply and demand in a narrow range. This requires considering transactions from the borders of the mid-term flat, formed in the July extremes.

To complete a trading plan, traders need to determine the trade direction. The last impulse movement occurred towards the direction of the Canadian dollar strengthening. The pair was able to gain a foothold below NKZ 1/2 1.3175-1.3165, which indicates a high probability of renewing the Friday's minimum. Today, there is a test of NKZ 1/4 1.3174-1.3169, which can become the starting point of the trade. If the closing of the American session occurs above the 1.3174 level, then it will be possible to consider the test of NKZ 1/2 1.3237-1.3227, where the most profitable prices for selling the instrument are located.

In order to be able to sell from the current marks, the closing of trades should be made below NKZ 1/4. This will allow to consider sales at less favorable prices. The weekly short-term target of decline is the of 1.3063-1.3041, which allows players to get 110 profit points from current marks. The size of the stop-loss should not exceed 30 points, so that the risk-to-profit ratio is acceptable.

To disrupt the downward momentum, today's US session should be closed above the level of 1.3237. This will rule out the potential renewal of the Friday's minimum and allow considering purchases already at the Asian session tomorrow. There is a 30% probability of forming a reversal pattern which makes it possible to consider it as an auxiliary one. The current phase of the movement is a medium-term accumulation. This requires fixing transactions for weekly and monthly extremes, even if the main goals have not yet been achieved.

Daytime CP is the daytime control zone. The zone is formed by important data from the futures market, which change several times a year.

Weekly CP is the weekly control zone. The zone is formed by important futures market marks, which change several times a year.

Monthly CP is the monthly control zone. The zone is a reflection of the average volatility over the past year.

* The presented market analysis is informative and does not constitute a guide to the transaction.

The material has been provided by InstaForex Company - www.instaforex.com