Data released on Monday in the afternoon, did not significantly affect the quotes of the US dollar or risky assets, as it fully coincided with the forecasts of economists.

Attention was focused on the meeting of US President Donald Trump with Russian President Vladimir Putin. As the number of experts notes, the meeting consisted of a constructive dialogue, which allows us to count on the restoration of good relations between the two countries in the future.

As for the fundamental statistics, the data on the growth of retail sales in the US did not lead to an increase in the US dollar.

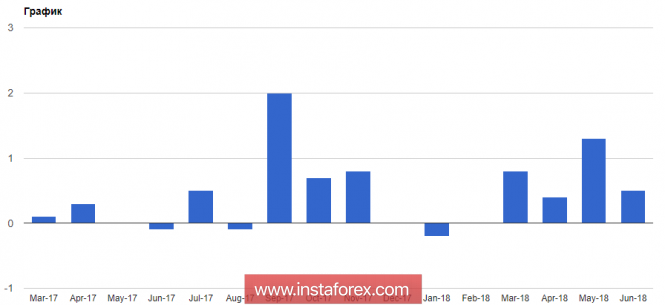

According to the report of the Ministry of Trade, retail sales in the US in June 2018 increased by 0.5% compared to the previous month, which fully coincided with the forecast of economists. This figure will certainly support the economic growth in the US in the future.

As noted, good growth was directly related to higher prices for gasoline and high sales of cars. Also, spending on healthcare has increased significantly. Excluding gasoline and cars, retail sales increased by only 0.3%.

The growth of business activity in the area of responsibility of the Federal Reserve Bank of New York has slowed due to a decrease in optimism about future activity. According to the report, the production index of the Fed-New York in July this year fell to 22.6 points from 25 points in June. Economists had expected the index to be 21 points.

Inventories of companies in the US in May rose.

Growing demand from consumers forced the company to increase its reserves, which will certainly support the US economy in the future. According to the report of the US Department of Commerce, the growth of inventories in May this year, compared to the previous month, was 0.4%. The data fully coincided with the forecasts of economists.

Speech by the representative of the Federal Reserve, Neel Kashkari, did not put serious pressure on the market, even though he spoke about the need for a slower increase in interest rates in the future.

As the representative of the Federal Reserve said, further increases in rates threaten to reverse the yield curve, and, in his opinion, there is almost no reason for a significant increase in rates. Kashkari also sees no signs of overheating of the economy, as monetary policy is already close to neutral. According to the representative of the Fed, it can always react quickly in case of a sharp increase in inflation.

The technical picture remained unchanged. Buyers need a breakthrough resistance of 1.1730, which will maintain an upside potential in risky assets with the main purpose of updating resistances 1.1760 and 1.1780.

The material has been provided by InstaForex Company - www.instaforex.com