Dear colleagues.

The Euro/Dollar pair is expected to continue its movement upward after the breakdown of 1.1684. The price of the Pound/Dollar pair almost increased the ascending structure from June 28 with a breakdown at 1.3099. For the Dollar/Franc pair, the level. 0.9969 is the key support for the downward structure from June 28. For the he Dollar/Yen pair, we follow the upward structure of June 26, the development is expected after the breakdown of 111.10. For the pair Euro/Yen, the continuation of the upward movement from June 28 is expected after the breakdown of 129.90. For the Pound/Yen pair, the price forms an upward structure from June 28, the development is expected after the breakdown of 146.70, currently the price is in the zone of initial conditions.

The forecast for July 3:

Analytical review of currency pairs in the H1 scale:

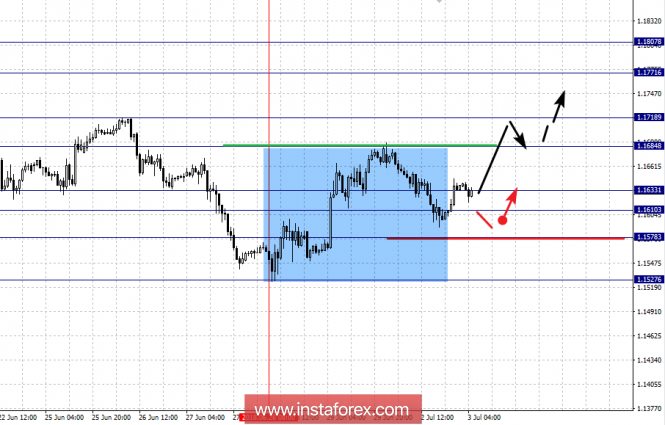

For the Euro/Dollar pair, the key levels on the H1 scale are: 1.1807, 1.1771, 1.1718, 1.1684, 1.1633, 1.1610 and 1.1578. Here, we continue to monitor the upward structure formation of June 28. The upward movement is expected to continue after the breakdown of 1.1684, in this case the target is 1.1718 near the consolidated level. The breakdown at the level of 1.1718 should be accompanied by a determined upward movement, with the target at 1.1771. The potential value for the top is the 1.1807 level and we expect a downward pullback upon reaching that area.

Short-term downward movement is possible in the corridor 1.1633-1.1610, breakdown of the last value will lead to an in-depth correction with the target at 1.1578, this level is the key support for the upward structure.

The main trend is the initial conditions for the top of June 28.

Trading recommendations:

Buy: 1.1684 Take profit: 1.1715

Buy 1.1722 Take profit: 1.1770

Sell: 1.1631 Take profit: 1.1611

Sell: 1.1608 Take profit: 1.1580

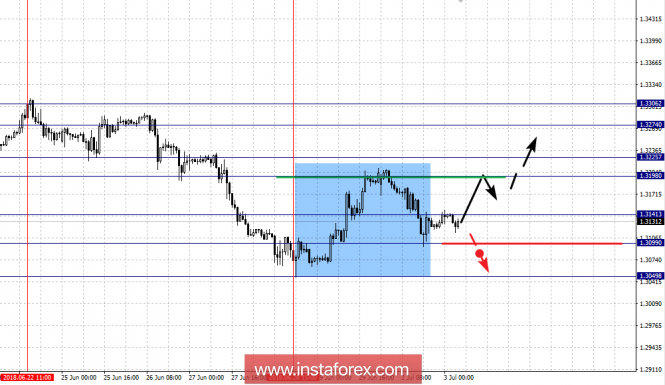

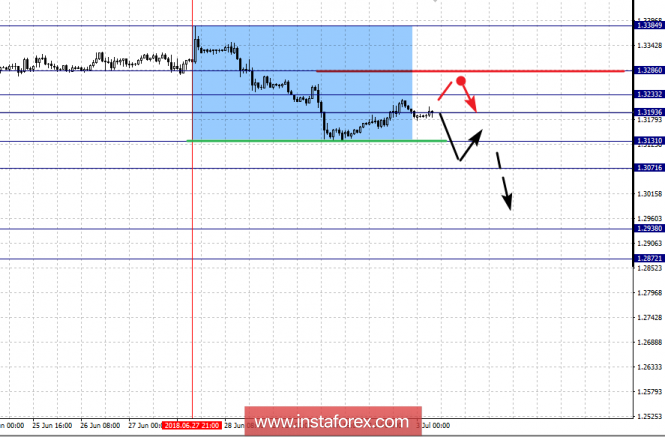

For the Pound/Dollar pair, the key levels on the H1 scale are 1.3306, 1.3274, 1.3225, 1.3198, 1.3174, 1.3165, 1.3141 and 1.3099. Here, the price almost lifted the ascending structure from June 28 which requires another breakdown at 1.3099, and in this case the first target is 1.3049. The upward movement is expected to continue after the breakdown of 1.3174, in this case the target is 1.3198. Short-term upward movement is expected in the corridor 1.3198 - 1.3225, the breakdown of the last value should be accompanied by a determined trend to the 1.3274 level. The potential value for the top is the level of 1.3306, we expect a downward pullback upon reaching that area.

The main trend is the upward structure formation of June 28

Trading recommendations:

Buy: 1.3198 Take profit: 1.3223

Buy: 1.3227 Take profit: 1.3272

Sell: 1.3165 Take profit: 1.3143

Sell: 1.3138 Take profit: 1.3105

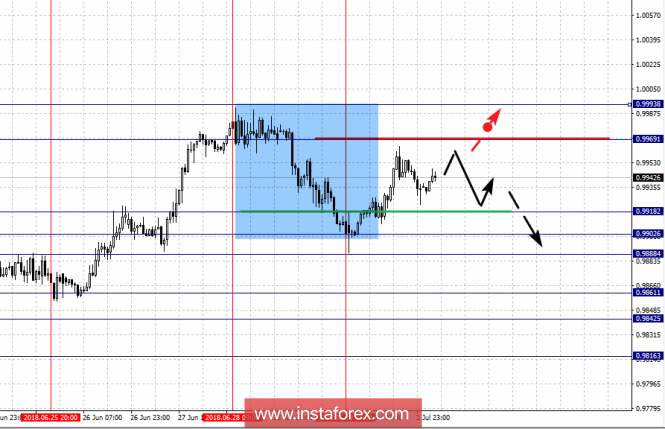

For the Dollar/Franc pair, the key levels in the H1 scale are: 0.9993, 0.9969, 0.9918, 0.9902, 0.9888, 0.9861, 0.9842 and 0.9816. Here, the reversal development of the downward structure from June 28 is expected after the breakdown of 0.9970, in this case the first target is 0.9993. The downward movement is expected to continue after the breakdown of 0.9918, with the target at 0.9902. Passage at the price of the noise range 0.9902 - 0.9888 should be accompanied by a determined trend, with the target at 0.9861, in the corridor 0.9861 - 0.9842 consolidation. The potential value for the bottom is the 0.9816 level, we expect an upward pullback upon reaching that level.

The main trend is the downward structure formation from June 28.

Trading recommendations:

Buy: 0.9970 Take profit: 0.9990

Buy: Take profit:

Sell: 0.9918 Take profit: 0.9902

Sell: 0.9888 Take profit: 0.9865

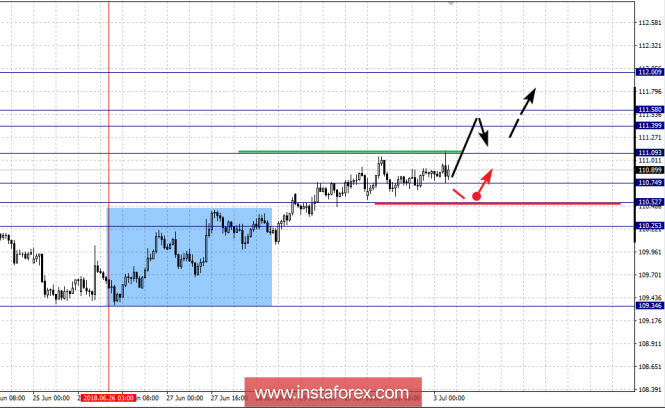

For the Dollar/Yen pair, the key levels on the scale are: 112.00, 111.58, 111.39, 111.09, 110.74, 110.52 and 110.25. Here, the continuation of the upward cycle from June 26 is expected after the breakdown of 111.10, and in this case the target is 111.39, in the corridor 111.39 - 111.58 consolidation. The potential value for the top is the level 112.00, and we expect a downward pullback upon reaching this level.

Short-term downward movement is possible in the corridor 110.74 - 110.52, the breakdown of the last value will lead to an in-depth correction. Here, the target is the 110.25 level which is the key support for the top.

The main trend is the upward structure of June 26.

Trading recommendations:

Buy: 111.10 Take profit: 111.36

Buy: 111.60 Take profit: 112.00

Sell: 110.73 Take profit: 110.52

Sell: 110.50 Take profit: 110.25

Short-term upward movement is possible in the corridor 1.3193 - 1.3233, the breakdown of the last value will lead to an in-depth correction with the target at 1.3286 level, which is the key support for the bottom.

The main trend is the downward structure formation from June 27.

Trading recommendations:

Buy: 1.3193 Take profit: 1.3231

Buy: 1.3235 Take profit: 1.3285

Sell: 1.3130 Take profit: 1.3073

Sell: 1.3068 Take profit: 1.2940

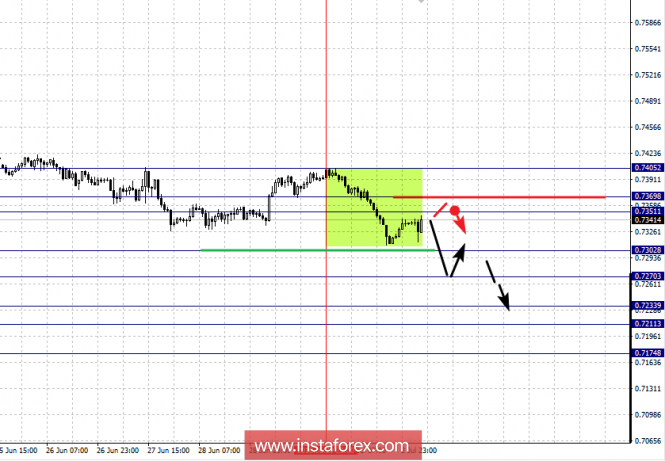

For the Australian Dollar/US Dollar pair, the key levels on the H1 scale are: 0.7405, 0.7369, 0.7351, 0.7302, 0.7270, 0.7233, 0.7211 and 0.7174. Here, we follow the local structure formation for the bottom of June 29. The downward movement is expected to continue after the breakdown of 0.7302, in this case the target is 0.7270 near the consolidation level. The breakdown at the 0.7270 level should be accompanied by a determined trend towards the 0.7233 level, in the corridor 0.7233 - 0.7211 consolidation. The potential value for the bottom is the level of 0.7174, we expect a rollback to the top upon reaching this level.

Short-term upward movement is possible in the corridor 0.7351 - 0.7369, the breakdown of the last value will form an upward structure with the target at 0.7405.

The main trend is a local downward structure from June 29.

Trading recommendations:

Buy: 0.7370 Take profit: 0.7405

Buy: Take profit:

Sell: 0.7300 Take profit: 0.7272

Sell: 0.7268 Take profit: 0.7235

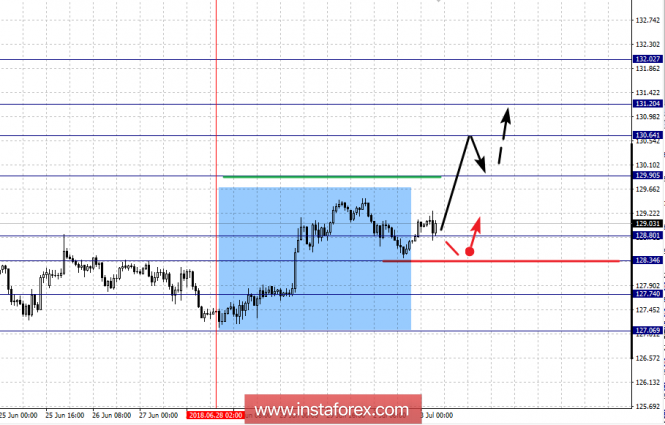

For the Euro/Yen pair, the key levels on the H1 scale are: 132.02, 131.20, 130.64, 129.90, 128.80, 128.34, 127.74 and 127.06. Here, the price has issued a determined structure for the upward movement of June 28. The upward movement is expected to continue after the breakdown of 129.90 with the target at 130.64. We expect short-term upward movement and consolidation in the corridor 130.64 - 131.20. The potential value for the top is the 132.02 level, we expect a downward pullback upon reaching that area.

Short-term downward movement is possible in the corridor 128.80 - 128.34, breakdown of the last value will lead to an in-depth correction with the target at 127.74, this level is the key support for the upward structure of June 28.

The main trend is the upward structure of June 28.

Trading recommendations:

Buy: 129.90 Take profit: 130.60

Buy: 130.66 Take profit: 131.20

Sell: 128.80 Take profit: 128.38

Sell: 128.30 Take profit: 127.80

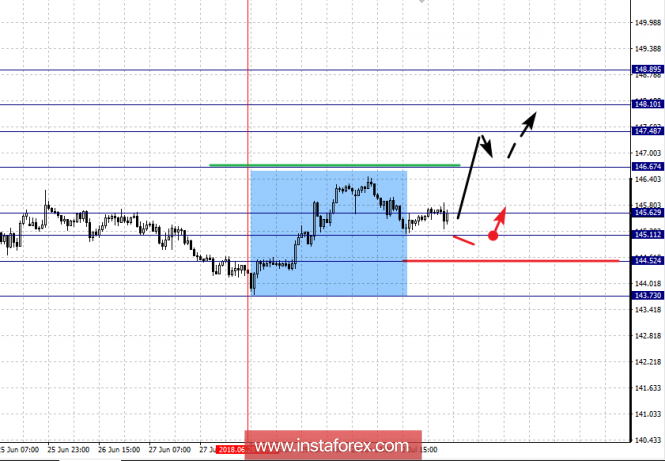

For the Pound/Yen pair, the key levels on the H1 scale are: 148.80, 148.10, 147.48, 146.67, 145.62, 145.11 and 144.52. Here, the price forms an upward structure from June 28. The upward movement is expected to continue after the breakdown of 146.67, with the target at 147.48, in the corridor 147.48 - 148.10 consolidation. The potential value for the top is the 148.89 level, we expect a downward pullback upon reaching this area.

Short-term downward movement is possible in the corridor 145.62 - 145.11, breakdown of the last value will lead to an in-depth correction with the target at 144.52, this level is the key support for the upward structure of June 28.

The main trend is the upward structure formation of June 28.

Trading recommendations:

Buy: 146.68 Take profit: 147.45

Buy: 147.50 Take profit: 148.10

Sell: 145.60 Take profit: 145.14

Sell: 145.10 Take profit: 144.55

* The presented market analysis is informative and does not constitute a guide to the transaction.

The material has been provided by InstaForex Company - www.instaforex.com