Dear colleagues.

For the currency pair Euro / Dollar, the price forms a local potential from July 27 to continue the upward trend. For the Pound / Dollar currency pair, the price is in correction and the continuation of the upward movement is expected after the breakdown of 1.3167. For the currency pair Dollar / Franc, the price forms a local descending structure from July 27. For the currency pair Dollar / Yen, the continuation of the movement downwards is expected after the passage at the price of the noise range of 110.84 - 110.60. For the currency pair Euro / Yen, the price forms potential initial conditions for the development of the upward cycle. For the Pound / Yen currency pair, we also expect the departure to the correction zone from the downward trend and the formation of the potential for the top.

Forecast for July 31:

Analytical review of currency pairs in the scale of H1:

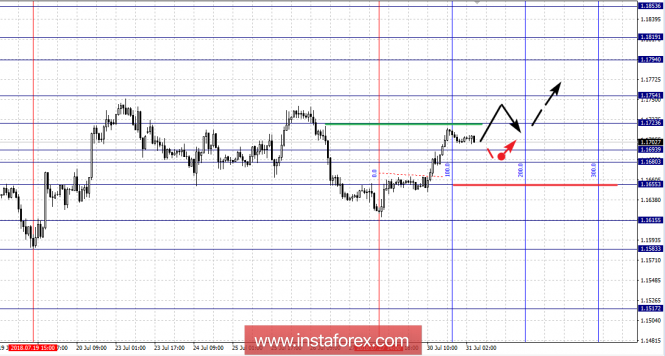

For the currency pair Euro / Dollar, the key levels on the scale of H1 are: 1.1853, 1.1819, 1.1794, 1.1754, 1.1723, 1.1693, 1.1680, 1.1655 and 1.1615. Here, the price forms a local structure for the continuation of the development of the upward trend of July 27. The continued upward movement is expected after the breakdown of 1.1723. In this case, the target is 1.1754 and near this level is the consolidation. The break of the level of 1.1755 should be accompanied by a pronounced upward movement to the level of 1.1794. The breakdown of 1.1794 will allow us to count on the move to 1.1819, near which we expect consolidation, as well as a possible pullback in the correction. The potential value for the top is the level of 1.1853. In general, the current price is in the second time zone, where we expect final registration of the initial conditions.

The short-term downward movement is possible in the corridor of 1.1693 - 1.1680 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 1.1655 and this level is the key support for the top.

The main trend is a local structure for the top of July 27.

Trading recommendations:

Buy: 1.1725 Take profit: 1.1752

Buy 1.1756 Take profit: 1.1792

Sell: 1.1680 Take profit: 1.1660

Sell: 1.1650 Take profit: 1.1620

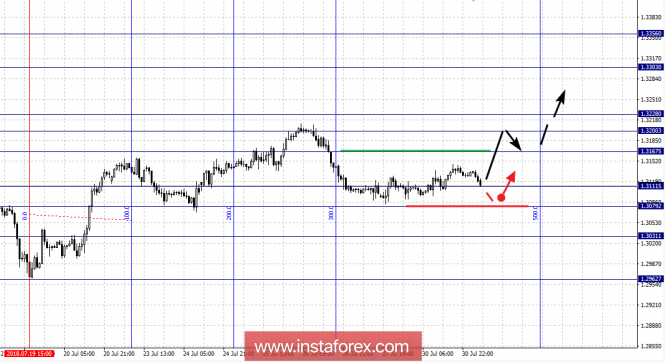

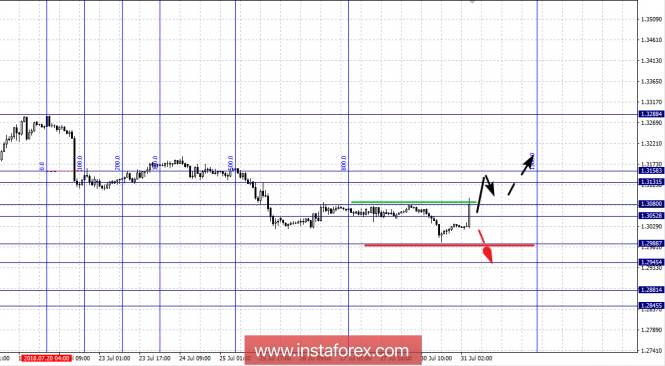

For the Pound / Dollar currency pair, the key levels on the H1 scale are: 1.3356, 1.3303, 1.3228, 1.3200, 1.3167, 1.3111, 1.3079 and 1.3031. Here, we continue to follow the development of the upward structure of July 19 and at the current time, the price is in the adjustment area. The continued upward movement is expected after the breakdown of 1.3167. In this case, the first target is 1.3200. The passage at the price of the noise range of 1.3200 - 1.3228 should be accompanied by a pronounced upward movement. Here, the target is 1.3303 and near this level is the consolidation. The potential value for the top is the level of 1.3356 and the probable achievement is July 26 - 27.

The short-term downward movement is possible in the corridor 1.3111 - 1.3079 and the breakdown of the latter value will lead to the formation of a downward structure. In this case, the target is 1.3031.

The main trend is the upward structure from July 19, the correction stage.

Trading recommendations:

Buy: 1.3167 Take profit: 1.3200

Buy: 1.3200 Take profit: 1.3226

Sell: 1.3110 Take profit: 1.3080

Sell: 1.3076 Take profit: 1.3031

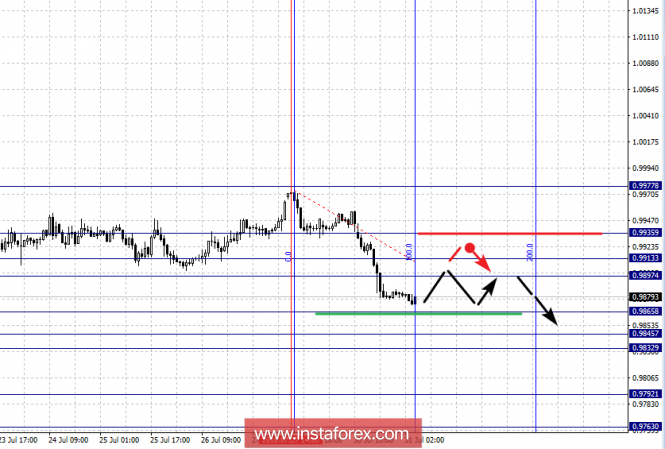

For the currency pair Dollar / Franc, the key levels on the scale of H1 are: 0.9935, 0.9913, 0.9897, 0.9865, 0.9845, 0.9832, 0.9792 and 0.9763. Here, the price forms a local structure for the downward movement of July 27. The continued downward movement is expected after the breakdown of 0.9865. In this case, the target is 0.9845 and near this level is the consolidation. The passage at the price of the noise range of 0.9845 - 0.9832 should be accompanied by a pronounced downward movement. In this case, the target is 0.9792. The potential value for the bottom is the level of 0.9763 and near this level, we expect consolidation, as well as a possible rollback to the top.

The short-term uptrend is possible in the corridor of 0.9897 - 0.9913 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 0.9935 and this level is the key support for the downward structure.

The main trend is a local downward structure from July 27.

Trading recommendations:

Buy: 0.9897 Take profit: 0.9911

Buy: 0.9915 Take profit: 0.9933

Sell: 0.9865 Take profit: 0.9845

Sell: 0.9830 Take profit: 0.9794

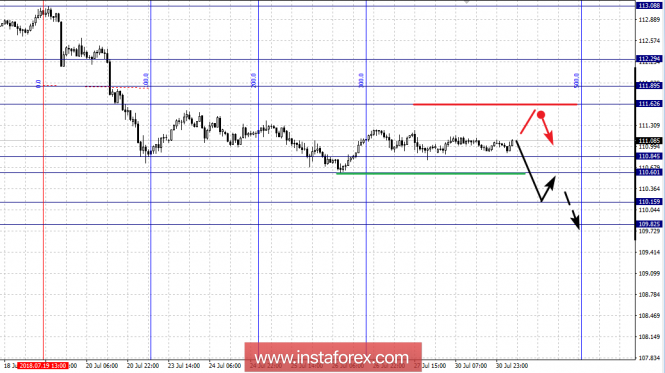

For the currency pair Dollar / Yen, the key levels on the scale of H1 are: 111.80, 111.42, 111.21, 110.84, 110.60, 110.15 and 109.82. Here, we follow the formation of the medium-term descending of July 19. The continuation of the movement downwards is possible after the passage at the price of the noise range of 110.84 - 110.60. In this case, the target is 110.15, upon reaching this level is the consolidation. The potential value for the bottom is the level of 109.82, from which we expect a rollback to the top.

The short-term upward movement is possible in the corridor of 111.62 - 111.89 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 112.29 and this level is the key support for the downward structure from July 19.

The main trend is the formation of the medium-term structure of July 19.

Trading recommendations:

Buy: 111.62 Take profit: 111.87

Buy: 111.92 Take profit: 112.26

Sell: 110.58 Take profit: 110.17

Sell: 110.13 Take profit: 109.84

For the Canadian Dollar / Dollar currency pair, the key levels on the H1 scale are: 1.3158, 1.3131, 1.3080, 1.3052, 1.2988, 1.2945, 1.2881 and 1.2845. Here, the price is in the 13th time zone and entered the equilibrium state. The short-term downward movement is possible in the range of 1.2988 - 1.2945. We consider the level of 1.2881 to be a potential value for the downward trend, after which consolidation is possible, and also a rollback to the top. At the moment, the price is in the final in the 8th time zone for the downward structure from July 20.

The short-term upward movement is possible in the corridor of 1.3052 - 1.3080 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3131 and the range of 1.3131 - 1.3158 is the key support for the top.

The main trend is the equilibrium state.

Trading recommendations:

Buy: Take profit:

Buy: 1.3085 Take profit: 1.3130

Sell: 1.2985 Take profit: 1.2945

Sell: 1.2942 Take profit: 1.2884

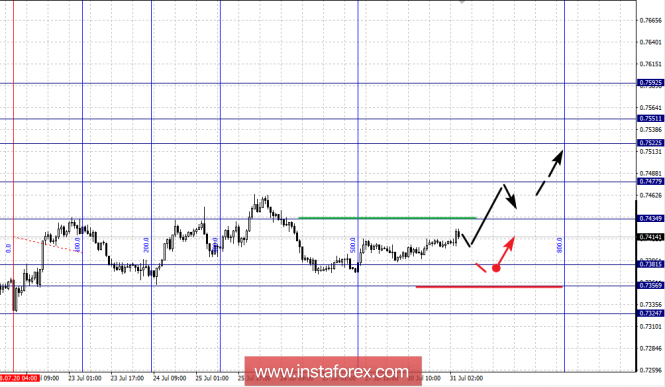

For the Australian Dollar / Dollar currency pair, the key levels on the H1 scale are: 0.7592, 0.7551, 0.7522, 0.7477, 0.7434, 0.7410, 0.7381, 0.7356 and 0.7324. Here, we follow the development of the upward structure of July 20. The continued upward movement is expected after the breakdown of 0.7434. In this case, the first target is 0.7477 and near this level is the consolidation. The breakdown of 0.7477 will allow us to count on the move to 0.7522 and in the corridor of 0.7522 - 0.7551 is the short-term upward movement, as well as consolidation. The potential value for the top is the level of 0.7592, after reaching this level we expect a pullback downwards.

The short-term downward movement is possible in the corridor of 0.7381 - 0.7356 and the breakdown of the last value will have to the development of a downward structure. Here, the first target is 0.7324.

The main trend is the upward structure from July 20, the correction stage.

Trading recommendations:

Buy: 0.7436 Take profit: 0.7475

Buy: 0.7480 Take profit: 0.7520

Sell: 0.7378 Take profit: 0.7358

Sell: 0.7354 Take profit: 0.7326

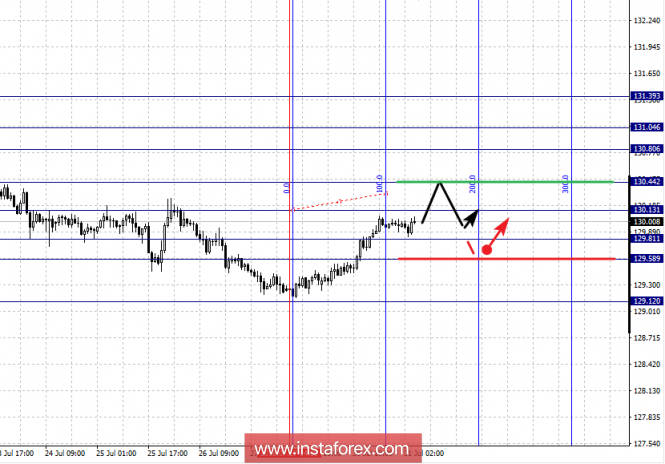

For the Euro / Yen currency pair, the key levels on the scale of H1 are: 131.39, 131.04, 130.80, 130.44, 130.13, 129.81, 129.58 and 129.12. Here, the price forms the potential for the development of the upward structure of July 27. The continuation of the upward movement is expected after the breakdown of 130.13. In this case, the target is 130.44 and the breakdown of which should be accompanied by a pronounced upward movement to the level of 130.80 and in the corridor of 130.80 - 131.04 is the consolidation. The potential value for the top is the level of 131.39, from which we expect a pullback downwards.

The short-term downward movement is possible in the corridor of 129.81 - 129.58 and the breakdown of the last value will have to form a local descending structure. Here, the potential target is 129.12.

The main trend is the formation of the potential for the top of July 27.

Trading recommendations:

Buy: 130.15 Take profit: 130.40

Buy: 130.50 Take profit: 130.80

Sell: 129.80 Take profit: 129.60

Sell: 129.50 Take profit: 129.15

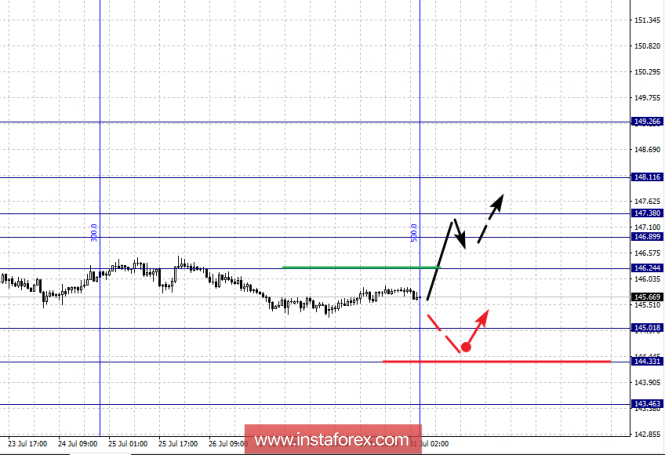

For the Pound / Yen currency pair, the key levels on the scale of H1 are: 148.11, 147.37, 146.89, 146.24, 145.01, 144.33 and 143.46. Here, we expect the design of the potential for the upward movement, for which a breakdown at the level of 146.30 is required. In the corridor of 145.01 - 144.33, we expect short-term downward movement, as well as consolidation. The potential value for the bottom is the level of 143.46, the movement to which we expect after the breakdown of 144.30.

We expect the correction to continue after the breakdown at 146.24. In this case, the first target is 146.89. The short-term upward movement is possible in the corridor of 146.90 - 147.37 and the breakdown of the last value will have to develop an ascending structure. Here, the first potential target is 148.11.

The main trend is a downward structure from July 16, we expect a correction.

Trading recommendations:

Buy: 146.30 Take profit: 146.85

Buy: 146.90 Take profit: 147.35

Sell: 145.00 Take profit: 144.45

Sell: 144.25 Take profit: 143.55

The material has been provided by InstaForex Company - www.instaforex.com