AUD/JPY has been quite corrective and volatile above the support area of 80.50-81.50 for a few days in a row. The price is now expected to climb higher towards 83.50 area in the coming days. The mixed economic reports from Japan are the main setback for JPY weakness against AUD.

Today, AIG Construction Index report was published with an increase to 56.0 from the previous figure of 54.0 which helped the currency to sustain the bullish momentum and push higher after the recent unchanged Cash Rate at 1.50%.

On the JPY side, today Household Spending report showed a significant decrease to -3.9% from the previous deficit of -1.3% which was expected to be at -1.5%, Average Cash Earnings increased to 2.1% from the previous value of 0.6% which was expected to be at 0.9%, and Leading Indicators showed a slight increase to 106.9% from the previous value of 106.2% which was expected to be at 106.5%.

As for the current scenario, JPY has been quite weak amid the economic reports recently compared to AUD. AUD is expected to gain further momentum over JPY in the coming days. Though the gains might be medium-term, gaining momentum will help AUD to show resilience further if Australia provides consistent positive economic reports to support the aussie's gains.

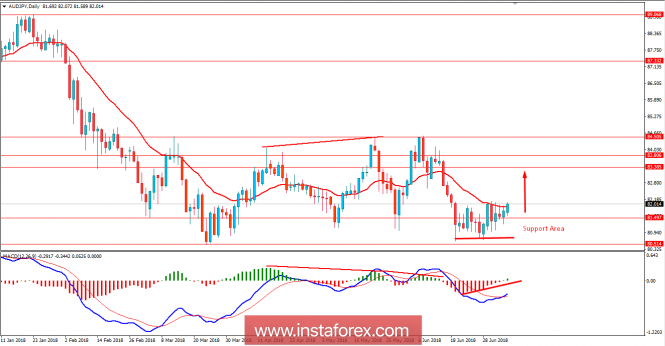

Now let us look at the technical view. The price is currently residing just above the support area of 80.50-81.50 area from where it is expected to push higher towards 83.50 area. Currently, the price is being held by the dynamic level of 20 EMA, though it might not be a big concern as Bullish Continuation Divergence is backing the upcoming bullish momentum in the pair. As the price remains above 80.50 with a daily close, the bullish bias is expected to continue further.