AUD/JPY has been residing inside the range between 80.50 to 84.50 for a few months now and currently, the price is expected to push lower towards the support area of 80.50 in the coming days. Despite the recent worse economic reports, JPY managed to maintain its momentum over AUD and expected to extend it further in the coming days.

AUD has been performing quite well with the economic reports but failed to meet the stamina it needed for standing against the impulsive JPY gains in the process. Today AUD PPI report was published with a decrease to 0.3% which was expected to be unchanged at 0.5%. After the positive increase in AUD Import Prices to 3.2% from the previous value of 2.0%, today's economic report pushed the market to further indecision against JPY.

On the JPY side, having a series of mixed economic reports this week, today JPY Tokyo Core CPI report was published with an increase to 0.8% which was expected to be unchanged at 0.7%.

As of the current scenario, the indecision and corrective momentum is expected to continue further as the mixed economic reports on the both currency in the pair struggles. Though AUD has been quite positive earlier but JPY managed to maintain that positive attitude to sustain the gains it managed throughout the previous days of the market but the indecision and volatile is still expected to exist in the market until the range boundary is broken with a daily close.

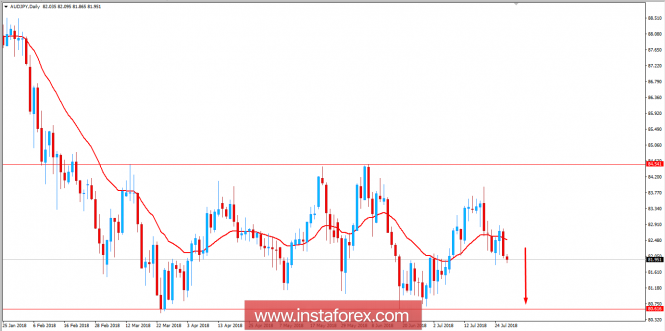

Now let us look at the technical view. The price is currently residing below the dynamic level of 20 EMA while residing below 84.50 area and a recent lower high in the process. Yesterday's bearish candle was quite powerful as it engulfed the previous bullish candles with an ease which also indicates upcoming bearish momentum in the process. As the price remains below 84.50 with a daily close, the bearish bias is expected to continue in this pair as the long-term trend is also bearish.

SUPPORT: 80.50

RESISTANCE: 84.50

BIAS: BEARISH

MOMENTUM: IMPULSIVE