AUD/USD has been quite volatile with the bearish trend it had started till it bounced off 0.8150 area with a daily close. Despite recent struggles on the USD side, AUD failed to gain momentum against USD.

Recently, after the worse-than-expected NFP report, USD failed to sustain the momentum it had over AUD. However, despite the positive economic reports from Australia, AUD lost ground again leading to bearish pressure in the pair. Recently, Westpac Consumer Sentiment report was published with a significant increase to 3.9% from the previous value of 0.3% and Home Loans increasing to 1.1% from the previous negative value of -0.9%. Today, AUD MI Inflation Expectation report was published with a slight decrease to 3.9% from the previous value of 4.2% which is currently helping AUD to gain certain momentum in the process.

On the other hand, today US CPI and Core CPI reports are going to be published and the indices are expected to be unchanged at 0.2%, Unemployment Claims are expected to decrease to 226k from the previous figure of 231k, and Natural Gas Storage is expected to decrease to 55B from the previous figure of 78B.

At present, AUD has been quite firm with the recent economic reports but failed to gain momentum because pending US economic reports are also well forecasted. So, better than expected readings may lead to further gains on the USD side in the coming days. The likelihood of another rate hike in the US is bullish for USD. Nevertheless, AUD may struggle to sustain its gains.

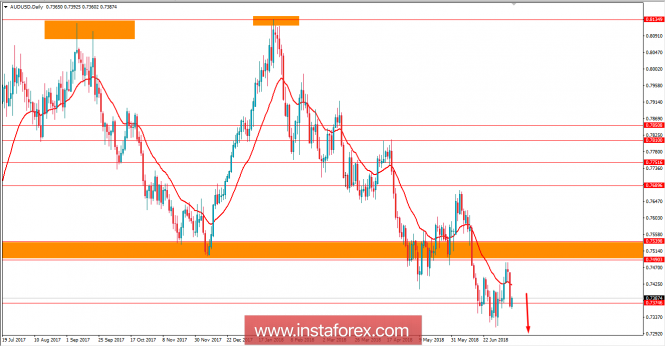

Now let us look at the technical view. The price is currently showing certain bullish pressure at the edge of 0.7350 area from where it is expected to push lower towards 0.7050 area in the coming days. The trend is still bearish but volatile which might lead to certain correction along the way down towards 0.70 area. As the price remains below 0.75 area with a daily close, the bearish bias is expected to continue.

SUPPORT: 0.7250, 0.7050

RESISTANCE: 0.7500-50

BIAS: BEARISH

MOMENTUM: VOLATILE