EUR/AUD has been corrective and volatile for a few weeks now which lead to a tight range between 1.57 to 1.59 area in the process. Due to indecision and recent Trade War issue, EUR could not sustain the bullish momentum it had earlier over AUD in the process.

Today AUD has been quite unchanged with the economic reports which lead AUD to lose certain grounds against EUR in the process. Today AUD CPI report was published with an unchanged value of 0.4% which was expected to increase to 0.5% and Trimmed Mean CPI report was also published unchanged at 0.5% which met the expectation as well.

On the EUR side, today German Ifo Business Climate report is going to be published which is expected to slightly decrease to 101.6 from the previous figure of 101.8, M3 Money Supply is expected to be unchanged at 4.0%, Private Loans are expected to increase to 3.0% from the previous value of 2.9% and Belgian NBB Business Climate is expected to decrease to 0.4 from the previous figure of 0.6.

As of the current scenario, EUR is quite optimistic about the upcoming economic reports whereas AUD is still quite indecisive. If the EUR economic reports perform better this week, EUR is expected to continue pushing the price higher in the coming days.

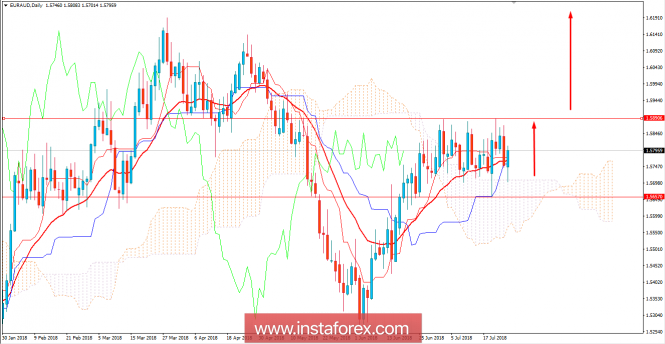

Now let us look at the technical view. The price has been quite volatile and corrective between the range bound of 1.57 to 1.59 area for a few weeks now. Though the price is still quite indecisive, having dynamic levels like 20 EMA, Tenkan and Kijun line supporting the upcoming move along with Kumo Cloud working as dynamic support may lead to upward move with a target towards 1.59 again and later towards 1.62 area in the future. As the price remains above 1.57 with a daily close, the bullish bias is expected to continue further.

SUPPORT: 1.57

RESISTANCE: 1.59

BIAS: BULLISH

MOMENTUM: VOLATILE AND CORRECTIVE