USD/CHF is currently quite volatile and corrective after being rejected off the 1.0050 area with an impulsive bearish momentum and daily close. Ahead of the upcoming high impact economic reports from the US, certain volatility is to hit this pair today.

Today, US Core Durable Goods Orders report is going to be published which is expected to increase to 0.5% from the previous value of 0.0%, Durable Goods Orders are expected to increase to 3.0% from the previous value of -0.4%, Unemployment Claims are expected to increase to 215k from the previous figure of 207k, Goods Trade Balance is expected to decrease to -67.0B from the previous figure of -64.8B, and Prelim Wholesale Inventories are expected to decrease to 0.5% from the previous value of 0.6%.

On the other hand, this week the economic calendar lacks macroeconomic reports or events in Switzerland to support CHF gains. Next week, KOF Economic Barometer, Retail Sales, and SECO Consumer Climate report are going to be published which are expected to inject certain volatility and may play an important part for the upcoming CHF gains over USD in the process.

At present, ahead of the upcoming high impact economic reports, USD has been trading amid bearish pressure. However, the long-term trend is still bullish and expected to push the price higher in the medium term.

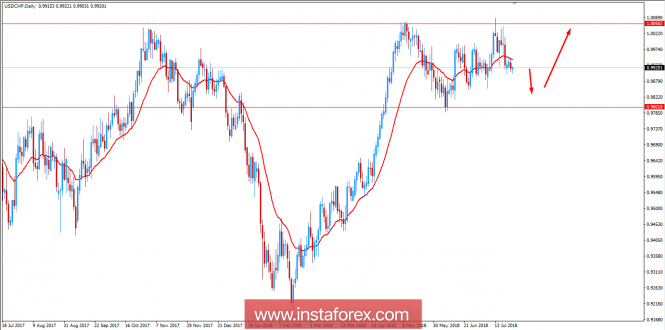

Now let us look at the technical view. The price is residing below 1.0050 area and below the dynamic level of 20 EMA which indicates that the bears are still in control and expected to push the price lower towards 0.98 support area before pushing higher with a target towards 1.0050 in the future. As the price remains above 0.98 area with a daily close, despite any impulsive bearish momentum the bullish bias is expected to continue further.

SUPPORT: 0.9800

RESISTANCE: 1.0050

BIAS: LONG-TERM BULLISH but SHORT-TERM BEARISH

MOMENTUM: VOLATILE