USD/JPY has been quite corrective and volatile at the edge of 110.50 area earlier, which is currently quite impulsive with the bullish momentum recently heading quite quickly towards 112.00 area. Though JPY has been quite positive with the recent economic reports but it failed to sustain the momentum to gain further against USD in the process.

Today JPY M2 Money Stock report was published unchanged as expected at 3.2% and Prelim Machine Tools Orders decreased to 11.4% from the previous value of 14.9%. The mixed economic report did prove as a setback for the JPY but without any high impact economic report on the USD side, current gain is completely assumed to be based on the JPY weakness.

On the USD side, after the recent NFP Economic report published with dovish results last week, USD has been quite weak recently. Today USD NFIB Small Business Index report is going to be published which is expected to decrease to 105.6 from the previous figure of 107.8 and JOLTS Job Opening report is going to be published with an increase to 6.88M from the previous figure of 6.70M.

As of the current scenario, despite having any high impact economic reports to be published this week USD has already gained a good amount of momentum against JPY which is expected to continue further until JPY comes up with better than expected economic results in a consistent basis.

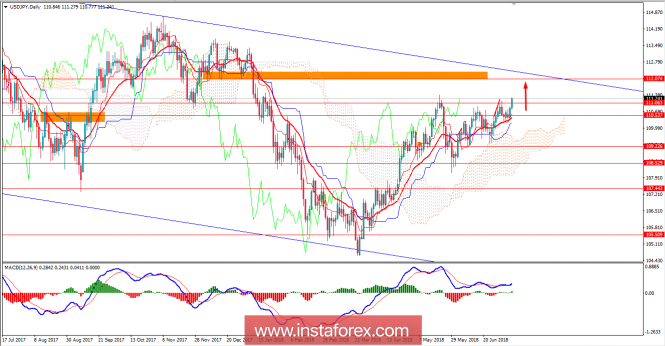

Now let us look at the technical view. The price is currently quite impulsive with the bullish gains after being bounced off the 110.50 area with a daily close. Despite the recent deeper pullbacks, the trend has been bullish and expected to push the price higher towards 112.00 area in the coming days. As the price remains above 110.50 with a daily close, the bullish bias is expected to continue further.