While all investors' attention was focused on the results of the meeting of the European Central Bank, a number of fundamental statistics on the US economy came out, which was mostly negative. Although, as we can see, this did not in the least hurt the US dollar.

According to the report of the US Department of Labor, the number of Americans who applied for unemployment benefits for the reporting week increased but remained in the lows in the last ten years. A good labor market situation is very important for the Federal Reserve System, as it is one of the key indicators of economic growth.

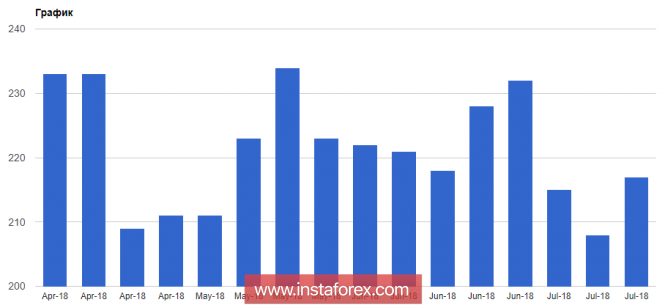

Thus, the number of initial applications for unemployment benefits for the week from 15 to 21 July increased by 9,000 and amounted to 217,000. Economists had expected the number of applications to be 215,000.

Orders for durable goods in the US in June rose slightly after a decline last month, which is a good sign of growth in the country's manufacturing sector.

According to the US Department of Commerce, new orders for durable goods in June 2018 increased by 1.0% compared to the previous month, which was worse than forecast, as economists expected that orders in June will grow by 3.0%.

It is important to note that in May, orders decreased by 0.3%, and in April, it declined by more than 1.0%. Excluding transportation, orders in June increased by 0.4% compared to the previous month after an increase of 0.3% in May.

The deficit of US foreign trade in goods continued to grow in June, despite all measures taken by the administration of the White House.

According to the report of the US Department of Commerce, the deficit of foreign trade in goods increased by 5.5%, or $ 3.6 billion, to $ 68.3 billion. In June, there was a drop in exports and an increase in imports.

Production activity in the area of responsibility of the Federal Reserve Bank of Kansas City continued to grow in July. However, the intensity of the respondents' reaction caused import duties. According to the data, the Fed-Kansas City index in July 2018 was 23 points against 28 points in June.

As for the technical picture of the EURUSD pair, the ascending channel is broken, which moved the trade into a wide lateral channel with a lower limit of 1.1570 and an upper resistance level of 1.1750. Buyers will try to catch on to support 1.1630 today . Otherwise, opening long positions in risky assets is best after updating the larger areas of 1.1605 and 1.1570.

The material has been provided by InstaForex Company - www.instaforex.com