Eurozone

Eurozone cannot stay away from the prospect of growing protectionism, which threatens to turn into a full-fledged trade war. The ECB meeting on June 14 considered this factor as the main risk for global growth.

The EU summit allowed reaching an agreement on immigration, but it became clear the following day that the head of the Ministry of Internal Affairs and the leader of the CSU party, Horst Seehofer, considered the results of the summit insufficient, while the Czech Republic, Hungary, and Poland refused to recognize its results de facto at all.

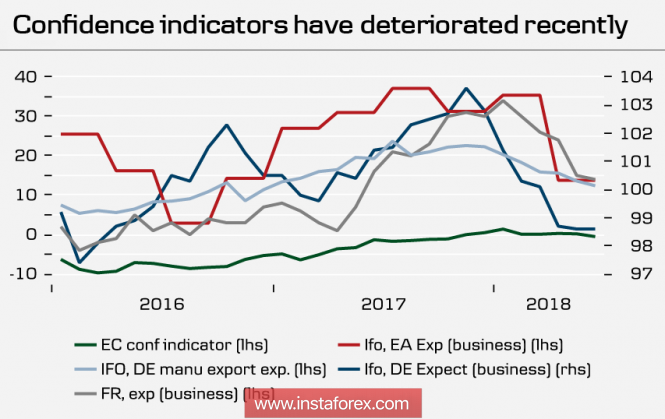

The ruling coalition of Germany faces the threat of its disintegration, which would mean early elections and Merkel's departure from the political Olympus. This is a factor of strong instability for the euro, which can exert pressure on him. Indicators of confidence in the euro area are declining and the German indicator Ifo in the area of two-year lows.

Published on Friday, Eurostat's report on inflation in June showed no deviations from expectations. Markit confirmed a slight slowdown in the manufacturing sector.

Currently, the euro has no objective reasons for the resumption of growth. Financial markets are closed during the US Independence Day on Wednesday. Hence, trading is likely to take place in a narrow range. On July 6, the "moment of truth" is expected on the trade restrictions of the US and China, which can significantly change the balance between the demand for risky and protective assets on a global scale. Also, the report on the US labor market will be released and we should expect a weak activity before this time.

On Tuesday and Wednesday, the EUR / USD will be traded in the range of 1.1600 / 1680, further dynamics will depend on data from the US. Strong data will open the way to 1.12. The weakened currency will allow overcoming the resistance 1.1680 and give a chance to resume corrective growth.

United Kingdom

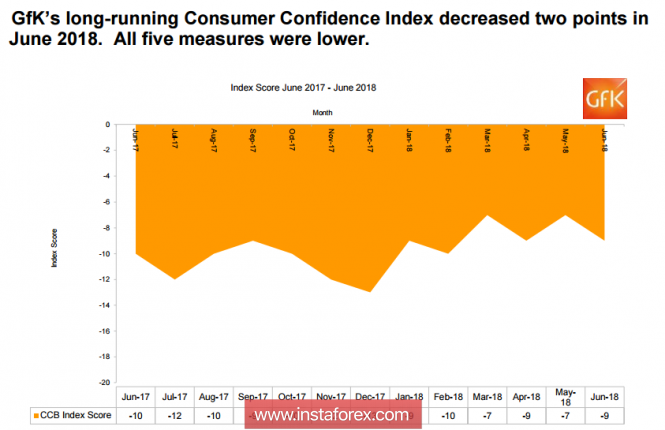

Macroeconomic data from the UK comes out mixed and does not give a clear picture of the pound's prospects. The adjusted GDP growth in the first quarter was only 1.2%, where there is a negative flow was recorded for commercial investments. In May consumer credit growth slowed down, consumer confidence index from Gfk decreased to -9 in June. There is no positive trend.

At the same time, there has been an increase in activity in the services sector and a decrease in the balance of payments deficit. There is an unexpected increase in PMI of the manufacturing sector to 54.4p in June, while a slight decline was projected. Markit's reports are of interest from the perspective of growth rates in August. the Bank of England should see positive dynamics in the economy in order to have a reason to raise the rate. Accordingly, the publication of Markit report on business activity in the services sector in June was able to support the pound in case of exceeding forecasts.

According to Brexit, there is no dynamic; the EU summit signaled to the British government that if it does not submit its proposals on a number of issues within the agreed timeframes, the exit may be formalized without a trade agreement and without a transition period.

The GBP/USD pair will continue trading in the range of 1.3100 / 80 in anticipation of new introductions. There is a slight possibility for the decline to resume by the end of the week.

Oil and ruble

As oil continues to grow, Brent is near $ 80 / bbl. and intends to make another attempt to go higher. The WTI reached a multi-year high of 74.81 dollars per barrel. Growth is facilitated by a number of factors such as problems with exports from Libya as it came out lower than predicted, oil reserves in the US, as well as an attempt to block all exports from Iran within the framework of the unspoken program "our weapons are unfair competition". The growth in production of OPEC + member countries, agreed last week, the market may regard as insufficient.

Going above 80 hinder the demand for the dollar and fears of a geopolitical nature on the eve of the start of the trade war between the US and China. By the end of the week, nevertheless, we expect Brent to grow above this level. For WTI, the goal is to gain a foothold above $ 75 / bbl.

The material has been provided by InstaForex Company - www.instaforex.com