EUR / USD pair

Monday passed by quietly in the market. The US Treasury Secretary Mnuchin even tried to smooth out the president's recent lull over monetary policy, saying that the government supports the Fed's independence. Sales of homes in the US secondary real estate market fell from 5.41 million to 5.38 million in June. In the euro area, the data also showed no improvement as the consumer confidence index for July remained at -1.

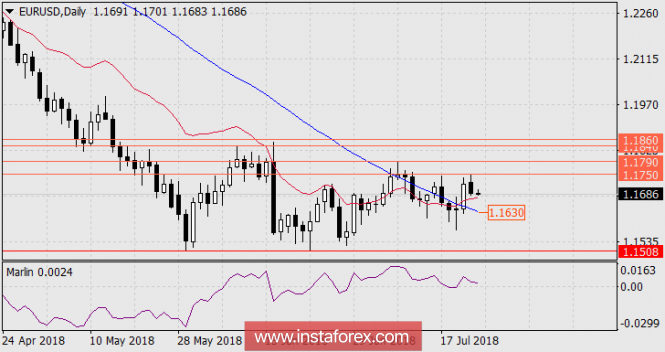

The euro was unable to break through the technical range of 1.1750 / 90, but on the daily chart, the price is still above the red balance sheet line and above the blue trend line. The Marlin Oscillator is also in the trend growth zone. At the turbulent discontent of Trump monetary policy of the Federal Reserve, investors responded to the sale of government bonds, which raised the yield of 5-year securities from 2.76% to 2.82%. The investors have pointedly preferred Trump's optimistic plans to the Fed.

On the four-hour chart, the price returned under the trend line, gaining a foothold in the previously indicated range of 1.1680-1.1700. But even here the price balance remains bullish, the price is higher than the red line, as well as, the signal line of the Marlin oscillator in the zone of positive numbers. There is no divergence price with an oscillator. This, of course, is not an obligatory element of the trend reversal, but this is quite frequent. As a result, uncertainty persists.

In the euro area today, business activity indicators for July will come out. Manufacturing PMI is projected to decrease from 54.9 to 54.7 while Services PMI is likely to decrease from 55.2 to 55.0. In the US, PMI services from Markit are projected to remain unchanged at 56.5, and Markit Manufacturing PMI is expected to fall from 55.4 to 55.1. That is, economic indicators can preserve the created neutral position.

The dollar has the only advantage during periods of calm on a global growing trend, as it has strengthened. However, the price must overcome the support of the trend line on a daily scale (1.1630). In this case, all the indicators on the daily and lower timeframes agree on the further medium-term price reduction. Today, there is no rush to market. On Thursday, these events are expected: ECB will decide on the monetary policy, the OPEC + monitoring committee meets and the US orders durable goods for June will be released.

The material has been provided by InstaForex Company - www.instaforex.com