The week ahead looks rather positive for important macroeconomic and political events, which can significantly affect the foreign exchange market.

One of the most anticipated events is the launch of the new package of US protectionist measures against China's main trading partner. Markets are waiting for an attempt to find a compromise solution over the remaining days, but these expectations are hardly justified. As we have repeatedly shown before, the Trump administration in fact has no other opportunity to successfully carry out reforms, except for a strict protectionism policy and without the capital inflow from outside the government will quickly develop a bankruptcy situation.

From the point of view of the US financial markets, the trade war prevails. Capital, fearing escalation, is fleeing from developing countries and some of them are supporting falling US stock exchanges. While China is consistently devaluing the yuan, but even the weakening of the currency does not prevent the Shanghai Composite index from falling much faster than the S&P 500.

The decline of the Shanghai Composite inevitably means a decrease in the Chinese PMI, given the strong correlation between these two indicators. The balance reduction rate of the Fed will reach 50 billion dollars by the end of the year, which will further weaken the emerging markets, and therefore, the tightening financial conditions meets the administration's plans.

On Thursday, the June minutes of the FOMC meeting will be published, which strengthened hawkish sentiments. It can be recalled that FOMC members raised their rate expectations of up to four increases this year and predicted for a rate hike above the neutral level for the next year, and also raised the forecast for inflation.

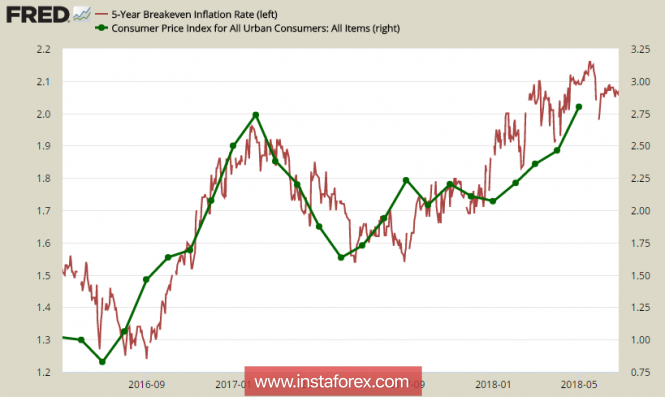

The final scenario showed an increased in interest. The Committee, in any case, continues to adhere with the "Phillips curve" and expects inflation to grow because of the increase in the average wage. If the market supported these calculations, it would also react with the rising expectations on inflation, but in the recent months, inflation has slowed down as shown on Friday by the Director of the US National Economic Council, Larry Kudlow. According to Kudlow, the policy of the Trump administration does not lead to an increase in inflation, and he hopes for a slower growth in the rates of the Fed.

If you focus on the yield of 5-year bonds TIPS, which are the most accurate tool for forecasting inflation in terms of business, showed a positive dynamics and there are no reasons for concern.

Non-farms payroll for June can significantly strengthen the dollar's position. At the moment, the forecasts are neutral and it is assumed that 190 thousand jobs were created in June, while the duration of the average working week, unemployment and wages forecasts will be at the level of May indicators. Any deviation of data from expectations will not cause reappraisal of the FRS' plans, but it will be able to extinguish inflation skepticism, which in itself will be a powerful stimulating factor.

The main idea of July is the preparation for a new recession. The yield spread between 2-year and 10-year bonds is shrinking, and one should expect that after two planned increases in rates, the yield curve is inverted by the end of the year. The supply reduction of money will lead to maintaining the growth of resource bubbles, and there will be no more supplies, thus, the recession will officially announce itself.

On Monday morning, all concerns aforementioned look exaggerated. The CFTC's Friday report showed an increase in demand for the dollar, while the cumulative short position on oil is declining, and the speculative position on gold is also shrinking. While the demand for the yen has decreased again, and all outwardly indicates that the favorite is the dollar, and not the defensive assets. At the same time, it is obvious that this situation will not last for a long time, and if the trade war gets a new round of escalation on July 6, it will be the defensive assets that will come to the fore.

Most likely, the EUR/USD pair will spend the day in the sideways range under the pressure of support 1.1610, while the GBP/USD pair will attempt to move up to 1.3250 which mean an attempt to break the bearish trend.

* The presented market analysis is informative and does not constitute a guide to the transaction.

The material has been provided by InstaForex Company - www.instaforex.com