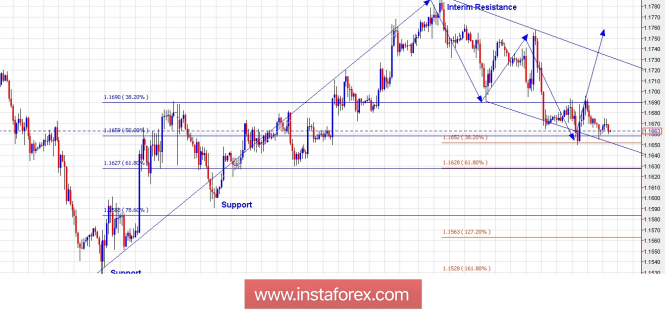

Technical outlook:

The EUR/USD pair formed a bottom around the 1.1650 levels yesterday, a few pips higher than what we expected and discussed yesterday. According to the Elliott Channel, it bounced from support and also a Fibonacci ratio as seen here. A high probable direction from here should be on the north side, above the 1.1850 levels. On the flip side, an alternate low at 1.1630 cannot be ruled out before the markets reverse higher. Price support remains at the levels of 1.1590 and 1.1530 respectively, while interim resistance is seen at 1.1790. Please note that the currency pair is into its probable wave 4 at a higher degree and until prices stay below the 1.2150 levels, the count remains valid. A break above 1.2150 would indicate further delays in the expected drop.

Trading plan:

Remain long with stop below the 1.1550/30 levels with the target of at least 1.1950

Fundamental outlook:

USD U. Michigan sentiment is due at 1000 AM EST and Fed Monetary Policy release to Congress is at 1100 AM EST.

Good luck!

The material has been provided by InstaForex Company - www.instaforex.com