The second phase of the trade war between the United States and China did not take long to happen. In less than a few days, the US announced the introduction of new duties on another group of Chinese goods. The list contains 6031 names with a total value of $ 200 bln, new tariffs are planned to be put into operation in 2 months.

The markets reacted extremely painful to the new stage of the escalation. The US dollar sharply increased, while oil prices collapsed, the Shanghai Composite index fell 1.8%, and the yuan fell to 6.7 per dollar.

First and foremost, the new list includes goods and the production of which is being developed as part of the "China-2025" strategy, that is, the US is trying to openly restrict China's economic growth without even trying to mask its ultimate goal. The Ministry of Foreign Affairs of China reacted immediately, according to the official representative of Hua Chunying, China will stand "on the right side of history" and is determined to take all necessary measures to protect its interests.

The increase in tariffs for the next group of goods was already expected, as the US administration warned in advance that it would put them into effect if China responded to the increase on July 6. Moreover, there is a plan to the 450 billion of imports that will be levied on higher tariffs, which corresponds to 90% of all Chinese exports to the US. The introduction of new fees will damage the Chinese economy, but not as significant as one would expect, given the unprecedented scale of the current happening.

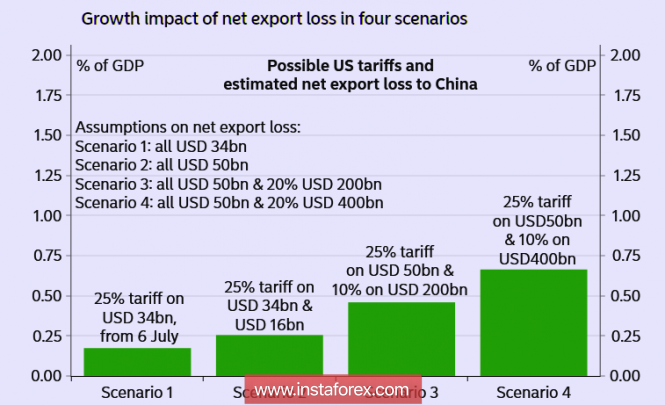

Net loss for China's GDP from the introduction of duties at $ 34 billion is about 0.2% according to calculations, which is not a catastrophe. The new increase in tariffs for 200 billion will bring a loss of 0.48%, 400 billion - less than 0.7%. Dependence on China's exports is high, but still significantly lower compared 10 years ago, the Chinese authorities will continue to stimulate domestic demand and will not weaken, but will accelerate the implementation of the China-2025 program.

Earlier, we repeatedly pointed out that the escalation of the trade war is inevitable. The US economic situation is much worse than reflected in the official statistics, and without decisive measures, the budget deficit and public debt will grow at an appalling rate. The attempts of the Trump administration to shift part of the costs to both the main trading partners and the NATO allies are quite obvious and easily predicted actions.

What is the response of China? Given that the trade balance is clearly not in his favor, the only thing that can seriously disrupt Washington's plans is the continuation of the de-dollarization of Chinese exports. China does not have any option than to stop the subsidizing of the US, reducing the volume of exports for dollars. China is the main external buyer of US Treasury bills, and unilateral actions of the United States will lead to the reduction of dollar flow.

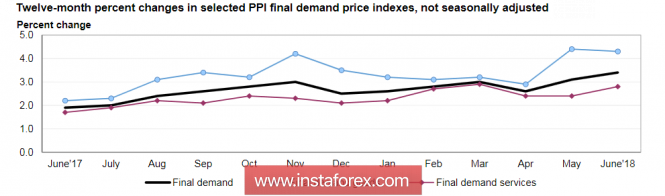

The new round of the trade war pushed back the economic factors themselves, but there are certain changes. Producer prices in June showed growth exceeding forecasts, as the annual price growth reached 3.4% which supports inflation expectations.

Today, consumer inflation data will be published in June, showing an increase of 0.2% is expected relative to May, while the annual inflation is projected to grow to 2.9%. If these expectations are realized, the dollar will receive another impetus, as the chances for a Fed rate hike for the fourth time in December this year will increase.

In the short term, the dollar will be in high demand. The USD/JPY pair may rise to 113.80, as the yen as a security asset weakened, while the GBP/USD pair will attempt for re-testing of 1.30, and the EUR/USD will continue to trade in the side range. At the same time, long-term dollar positions look uncertain, much will clarify the Treasury report on the foreign capital inflow in May, which will be published on July 17.

* The presented market analysis is informative and does not constitute a guide to the transaction.

The material has been provided by InstaForex Company - www.instaforex.com