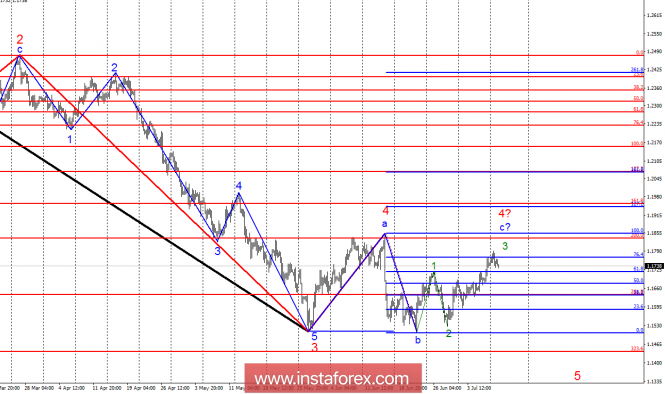

Analysis of wave counting:

During the trades on Monday, the currency pair EUR / USD added several points and remained, therefore, within the framework of the proposed wave 3, c, 4. Thus, the wave pattern for the past day did not change, and the pair has a good potential for further increase with goals that are about 19 figures. At the same time, as long as the pair did not break the maximum of the assumed wave a, at 4, the probability that the entire trend section, which takes its origin on June 14, is transformed into the first waves in the future wave 5 of the trend's downward segment remains.

The objectives for the option with sales:

1.1440 - 323.6% of the Fibonacci of the highest order

1.1118 - 423.6% of Fibonacci

The objectives for the option with purchases:

1.1866 - 100.0% of Fibonacci

1.2072 - 127.2% of Fibonacci

General conclusions and trading recommendations:

The currency pair EUR / USD continues to build wave 3, c, 4. Thus, on July 10, I recommend to remain in purchases with targets located near the calculated marks of 1.1856 and 1.2072, which equates to 100.0% and 127.2% by Fibonacci. I recommend returning to sales after receiving confirmation of the completion of the whole wave 4 or about the transformation of the site from June 14 to wave 5. At the moment, there is no sign of such scenario.

The material has been provided by InstaForex Company - www.instaforex.com