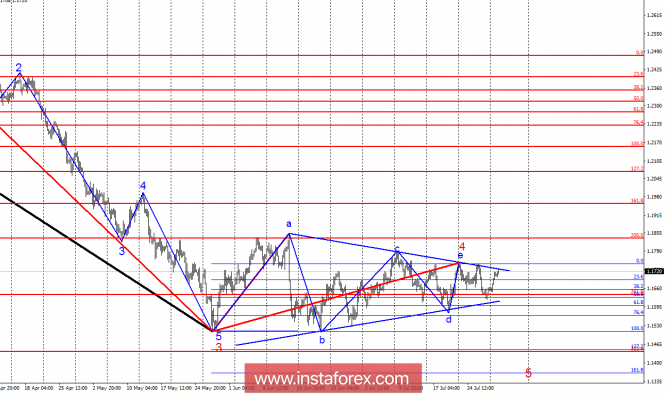

Analysis of wave counting:

During the trades on Monday, the currency pair EUR / USD added about 50 percentage points and is still traded inside a tapering corridor. The fifth time the pair tested the upper line forming the corridor, and the attempt of its breakthrough is again unsuccessful. If the next attempt is still ended with the breakthrough of this line, then the entire wave pattern will require additions. Also in this case, the instrument will proceed to build an upward set of waves with the first targets, about 1.1834, which corresponds to 200.0% of Fibonacci. However, the working option is now still the option of reducing the pair within the proposed wave 5.

The objectives for the option with sales:

1.1507 - 100.0% of Fibonacci

1.1444 - 127.2% of Fibonacci

The objectives for the option with purchases:

1.1834 - 200.0% of Fibonacci

1.1957 - 161.8% of Fibonacci

General conclusions and trading recommendations:

The correction wave 4 is still characterized as complete. Thus, I recommend continuing the formation of the pair's sales with the aim of building wave 5 of the downward trend section with targets located near the marks of 1.1507 and 1.1444, which corresponds to 100.0% and 127.2% of Fibonacci. To buy a pair, I recommend returning after the breakout of the upper line of the narrowing corridor and the refinement of all wave counting.

The material has been provided by InstaForex Company - www.instaforex.com