While the market is speculating that more importantly, the reduction of US stocks or the sale of oil from strategic reserves, sanctions against Iran or a slowdown in global demand, Brent and WTI are moving toward consolidation. Meeting representatives of Washington and Beijing on the eve of the expansion of US import duties on the supply of goods from China from $ 34 billion to $ 50 billion is perceived as a "bullish" factor for black gold. China is its largest consumer, so the slowdown in GDP is perceived by investors as a factor in reducing global demand. An armistice between conflicting parties, on the contrary, interest in oil should be strengthened.

The trade war is one of the reasons why Beijing will continue to buy oil from Iran despite Washington's calls to reduce exports from this Middle Eastern country to zero. And if European and Japanese companies are on the sidelines of the United States because of fears that the latter will block their oxygen on concluded deals in US dollars, then the position of the Celestial Empire compels her to not be afraid of anything. The Americans are going to openly blackmail, the Chinese media claim that their country will never be Washington's vassal.

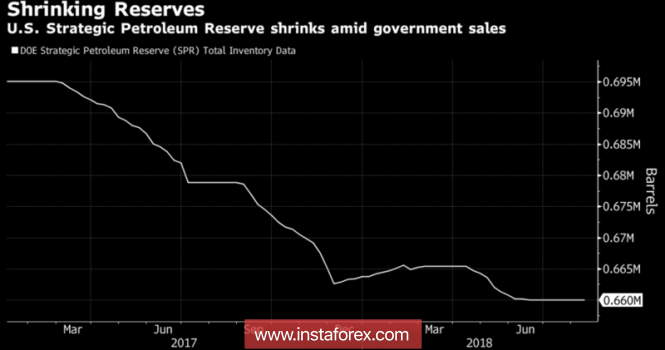

Donald Trump and his team are well aware that sanctions against Tehran will result in rising oil prices, which will hit the wallets of Americans buying gasoline and may slow down their spending and gain cruising speed of GDP. In such a situation, the decision to sell 11 million black gold from a 660 million strategic reserve for two months seems to be the right decision. Yes, the figure is not so great in comparison with the withdrawal from the market of 0.7-1 million b / s of Iranian extraction, however, the dashing trouble began!

Dynamics of strategic oil reserves in the USA

The states decided to take matters into their own hands after Saudi Arabia, instead of fulfilling the June promise to increase production, reduced it in July. According to BNP Paribas, OPEC oil production will decrease to 32.1 million b / s in 2018 and to 31.7 million b / s in 2019. Simultaneously, the French bank expects to see a production increase outside the cartel by 2 million b / s in the current and by 1.9 million b / s next year. World demand will increase by 1.4 million b / s per year in 2018-2019.

The "bullish" factors include the adjustment of unexpectedly grown by the end of the five-day period by August 10 US stocks and some weakening of the US dollar against the backdrop of Donald Trump's dissatisfaction with the policy of the Fed. According to Bloomberg experts, stocks will drop by 2 million b / d by August 17. The US president claims that he appointed Jerome Powell to the post of chairman of the Central Bank because of his "pigeon" views. Now the owner of the White House is disappointed by the too rapid increase in the rate of federal funds.

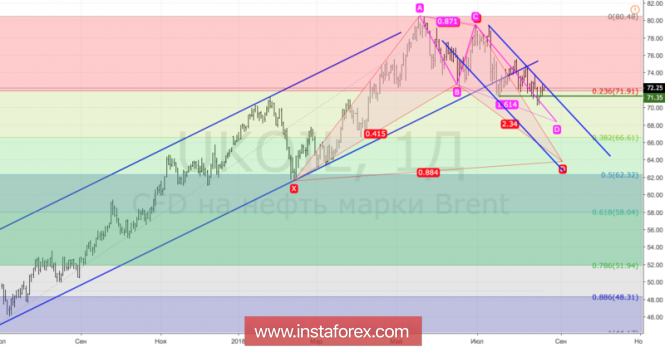

Technically, the "bulls" for Brent were able for the third time in a row to repel an attack of opponents on support at $ 71.35 per barrel and go into a counteroffensive. Despite the fact that "bears" do not leave hopes for the implementation of the target at 161.8% and 88.6% for the AB = CD and "Bat" patterns, a confident assault on the upper boundary of the downward trading channel will increase the risks of continuing the rally.

Brent, the daily chart