This week, the pair tested the monthly short-term fault of August, which allowed to observe the growth in demand. The probability of forming a deep correctional or reversal model has increased to 70%.

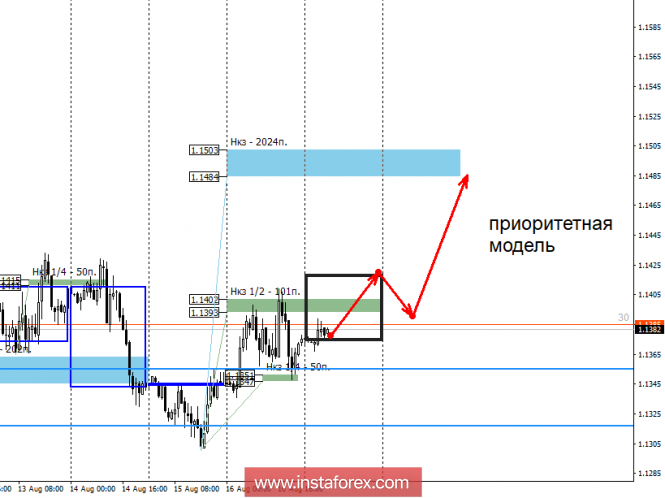

Yesterday, the pair formed a local accumulation zone between the two control zones. Support is the NCP 1/4 1.1351-1.1347. Fixing the price above the specified zone allows you to hold the purchase, the first goal of which is the NCP 1/2 1.1402-1.1393. To continue the growth will require the closure of today's US session above the level of 1.1402. If this happens, then purchases can be held already up to a week-long short-term target of 1.1503-1.1484, and also look for new favorable prices for the opening of a long position in the medium term.

The continuation of the flat will be actual if the closure of the American session occurs below the NCP 1/2. In this case, the probability of renewing the August low will remain, where it will be possible to again consider purchases, the purpose of which will be to return within the limits of the monthly short-term.

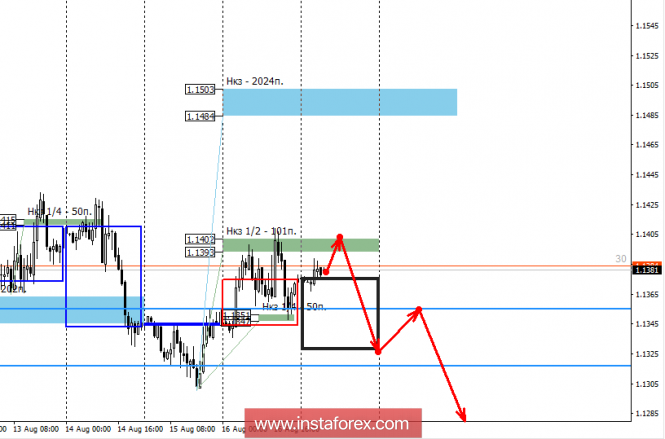

An alternative model for the continuation of the fall will become relevant if today the pair can not gain a foothold above NCP 1/2, and a sharp increase in supply will lead to the absorption of yesterday's growth. Closure of the American session should occur below yesterday's opening of trading. This model will indicate the continuation of the formation of the bearish model, and the first goal will be the minimum of August.

The daily short-term fault is the daytime control zone. The zone formed by important data from the futures market, which change several times a year.

The weekly short-term fault is the weekly control zone. The zone formed by important futures market marks, which change several times a year.

The monthly short-term fault is the monthly control zone. The zone, which is a reflection of the average volatility over the past year.

The material has been provided by InstaForex Company - www.instaforex.com