The July report on the US labor market published on Friday is expected to be strong. The number of new jobs was less than forecast (+ 157k against + 190k), however, this gap was compensated by the revision of the previous months to + 59k. The unemployment rate and the participation level in the workforce were unchanged, which makes it possible to expect the growth of the average wage already in the next report.

The report allows the Fed to adhere its desired plan to gradually raise the rate, but this factor will not have a significant merge on the dollar.

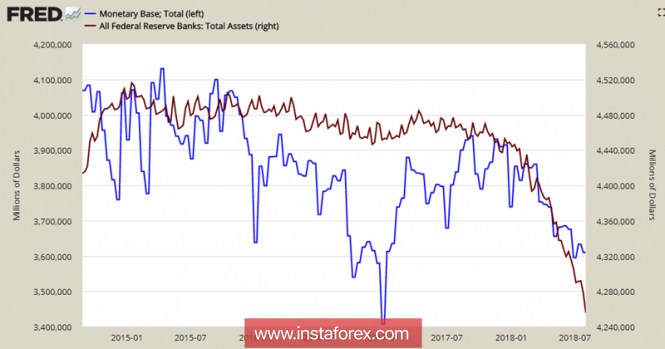

Meanwhile, the Fed continues to reduce the balance, the last major write-off of $ 28.5 billion occurred on July 31. The dollar reacted with such growth, offsetting the negative factor from the disappointing inflation report. The next write-off will take place on August 15 and $23.1 billion will be liquidated, the reduction of the monetary base is still behind the balance, but the gap is expected to be reduced. While the largest decline in the monetary base was recorded on the second half of 2016, which coincided with a sharp increase in the dollar. There is a reason to believe that this factor will contribute to the demand growth for the dollar, especially in the near future.

The dollar will continue to trade in the sideways range against most competitors, but changes in monetary policy seems favorable for its further growth.

Eurozone

The euro did not receive any new benchmarks last week. PMI Indices from Markit for July came in line with expectations generally and is slightly worse than the dynamics of retail sales, but not so much as to cast doubt on the forecasts for consumer demand.

Secondary factors, such as sluggish Brexit negotiations or Italian elections cannot change the investors' mood who are inclined to the weaker euro because of the absence of any bullish drivers.

The EUR/USD pair close again to the 1.15 support, and the probability of a decline to this level remains high.

United Kingdom

The Bank of England increased the rate by a quarter of a percent, which was already expected by the market, but the strong unanimity of the Cabinet members was a strong surprise. This factor could be considered hawkish but the market decided that the BoE's confidence is rather ostentatious, as key macroeconomic forecasts do not contribute to higher rate growth rates than the market expectations. The volume of purchases remained at the level of 435 billion pounds, while the balance reduction is not yet done as the rate reaches until 1.5% and it is necessary to see at least 3 increases in the coming years.

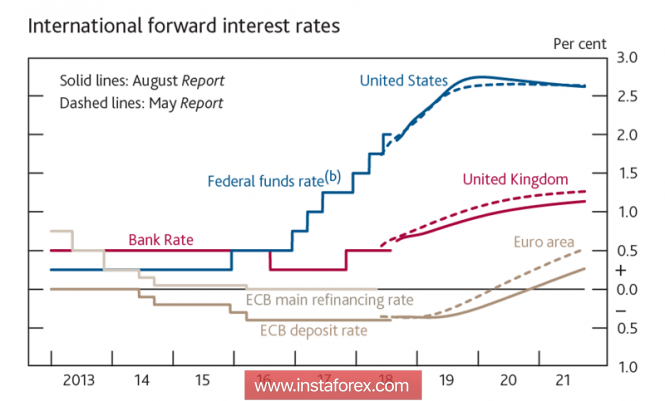

The economic growth forecast for 2018 and 2019 had increased, but the pound is unlikely to take advantage of this factor. In the inflation report, the BoE predicts a smoother curve for the rate for the UK and the eurozone in the coming years. While according to the opinion of the bank, the Fed's actions maybe slightly more aggressive than the market expectations. This forecast indicates that the dynamics of the yields spread will increase in favor of the dollar, which puts a big question mark before the bulls on the pound.

The pound declined in the results of the meeting which indicates the unconvincing position of the Bank of England, unable to convince the markets in economic prospects. By Monday, the pound has fallen again below 1.30 and the formation of a new low is at 1.2940 would likely happen during the day, the attempts at growth will be inconclusive.

Oil

Despite the fact that oil production in the United States has declined, as well as reports that Saudi Arabia had a reduction in production in July, oil continues to trade in the lateral range. The growth is hampered by the likely escalation of the US-China trade war, which the market regards as a possible reduction in the energy demand from China.

Brent will try to leave above 73.70, but positive news for the market is still not enough.

* The presented market analysis is informative and does not constitute a guide to the transaction.

The material has been provided by InstaForex Company - www.instaforex.com