Dear colleagues.

For the EUR / USD pair, the price is in the correction zone. The level of 1.1455 is the key support for the downward cycle from August 8. For the GBP / USD pair, we expect the continuation of the movement downward. We are wait after passing the price of the noise range of 1.2684 - 1.2655. For the USD / CHF pair, the subsequent goals for the top were determined from the upward structure on August 14. For the USD / JPY pair, the upward trend is expected after passing the price of the noise range of 110.91 - 111.10. For the EUR / JPY pair, the price forms a local downward structure from August 14. The development of this level is expected after the breakdown of 124.82. For the GBP / JPY pair, the price also forms a local structure for the bottom of August 14. The downward movement is expected after the breakdown of 139.86.

Forecast for August 17:

Analytical review of currency pairs in the scale of H1:

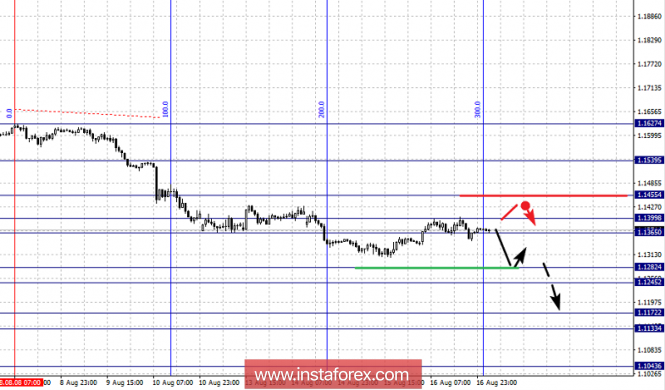

For the of EUR / USD pair, the key levels on the scale of H1 are: 1.1539, 1.1455, 1.1399, 1.1365, 1.1282, 1.1245, 1.1172, 1.1133 and 1.1043. Here, we continue to follow the downward cycle from August 8. At the moment, the price is in correction. Short-term downward movement is possible in the area of 1.1282 - 1.1245. The breakdown of the last value should be accompanied by a pronounced downward movement towards the level of 1.1172. In the area of 1.1172 - 1.1133 is the consolidation of the price. The potential value for the bottom is the level of 1.1043, the movement toward which we expect after the breakdown of 1.1131.

Consolidated traffic is possible in the area of 1.1365 - 1.1399. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.1455. This level is the key support for the downward structure. Its breakdown will lead an upward movement. In this case, the target is 1.1539.

The main trend is a local downward structure from August 8, the correction stage.

Trading recommendations:

Buy: 1.1401 Take profit: 1.1452

Buy 1.1457 Take profit: 1.1537

Sell: 1.1244 Take profit: 1.1174

Sell: 1.1132 Take profit: 1.1045

For the GBP / USD pair, the key levels on the scale of H1 are 1.2907, 1.2825, 1.2763, 1.2727, 1.2684, 1.2655, 1.2601 and 1.2561. Here, we continue to follow the local downward cycle from August 7. The continuation of the downward movement is expected after passing the price of the noise range 1.2684 - 1.2655. In this case, the target is 1.2601. The potential value for the bottom is the level of 1.2561, after which we expect consolidation in the area of 1.2601 - 1.2561.

Short-term upward movement is possible in the area of 1.2727-1.2763. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.2825. This level is the key support for the bottom. Passing by the price will lead to form the initial conditions for the top. In this case, the potential target is 1.2907 .

The main trend is the local downward structure of August 7.

Trading recommendations:

Buy: 1.2727 Take profit: 1.2760

Buy: 1.2765 Take profit: 1.2822

Sell: 1.2655 Take profit: 1.2604

Sell: 1.2658 Take profit: 1.2562

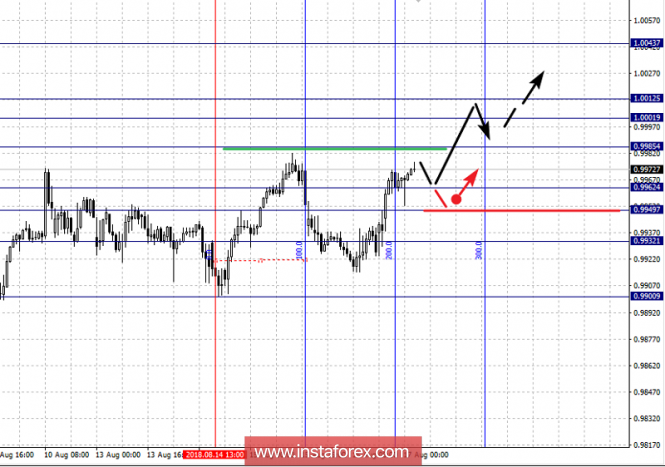

For the USD / CHF, the key levels on the scale of H1 are: 1.0043, 1.0012, 1.0001, 0.9985, 0.9962, 0.9949, 0.9932 and 0.9900. Here, we clarified the subsequent goals from the upward structure on August 14. The continuation of the upward movement is expected after the breakdown of 0.9985. In this case, the target is 1.0001. In the area of 1.0001 - 1.0012 is the consolidation of the price. Break of the level 1.0012 will allow us to count on the movement towards the potential target of 1.0043, from this level we expect a pullback downwards.

Short-term downward movement is possible in the area of 0.9962 - 0.9949. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.9932. This level is the key support for the top.

The main trend is the formation of the upward structure of August 14.

Trading recommendations:

Buy: 0.9985 Take profit: 1.0000

Buy: 1.0014 Take profit: 1.0040

Sell: 0.9960 Take profit: 0.9952

Sell: 0.9946 Take profit: 0.9934

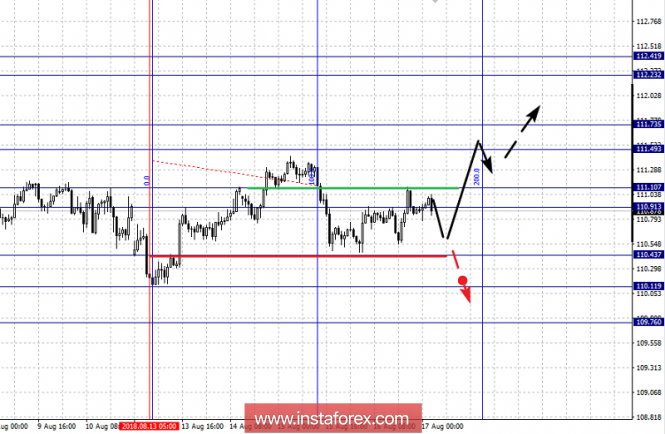

For the USD / JPY, the key levels on a scale are: 112.41, 112.23, 111.73, 111.49, 111.10, 110.91, 110.43, 110.11 and 109.76. Here, we consider the upward structure of August 13 as medium-term initial conditions, the development of which is expected after passing the price of the noise range 110.91 - 111.10. In this case, the first target is 111.49. In the area of 111.49 - 111.73 short-term upward movement, as well as is the consolidation of the price. The level 111.75 break should be accompanied by a pronounced upward movement towards the potential target of 112.41, upon reaching this level we expect consolidation in the area of 112.23 - 112.41.

Level 110.43 is the key support for the upward structure of August 13. Its breakdown will lead to the development of a downward movement. In this case, the first target is 110.11. The potential value for the bottom is the level of 109.76.

The main trend: medium-term upward structure of August 13.

Trading recommendations:

Buy: 111.11 Take profit: 111.47

Buy: 111.52 Take profit: 111.70

Sell: 110.41 Take profit: 110.13

Sell: 110.08 Take profit: 109.78

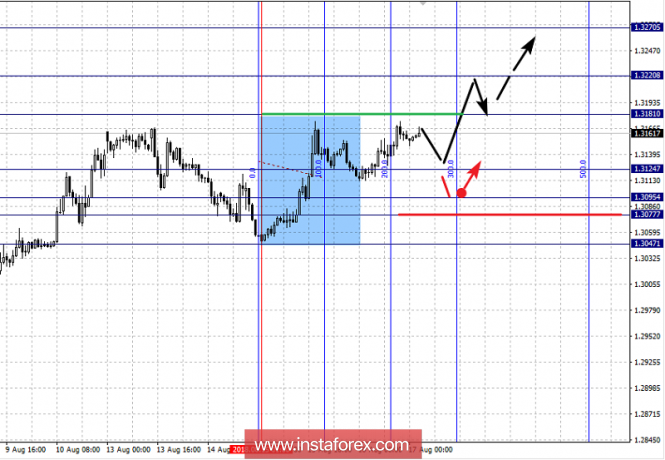

For the CAD / USD pair, the key levels on the scale of H1 are: 1.3270, 1.3220, 1.3181, 1.3124, 1.3095, 1.3077 and 1.3047. Here, the price forms a local structure for the development of the upward movement of August 15. The continuation of the upward movement is expected after the breakdown of 1.3181. In this case, the target is 1.3220. Near this level is the consolidation of the price. The potential value for the top is the level of 1.3270, the movement towards which we expect after the breakdown of 1.3222.

The correction is expected after the breakdown of 1.3124, the target is 1.3095, the range 1.3095 - 1.3077 is the key support for the top. Passing by the price will lead a downward tendency. In this case, the target is 1.3047.

The main trend is the formation of a local upward structure of August 15.

Trading recommendations:

Buy: 1.3181 Take profit: 1.3220

Buy: 1.3222 Take profit: 1.3268

Sell: 1.3122 Take profit: 1.3097

Sell: 1.3075 Take profit: 1.3049

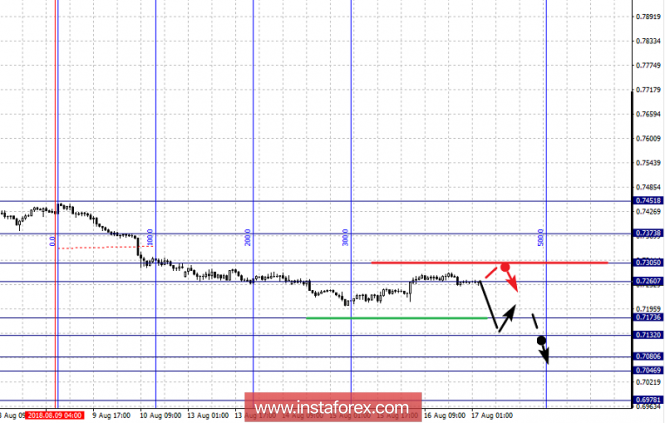

For the AUD / USD pair, the key levels on the scale of H1 are: 0.7373, 0.7305, 0.7260, 0.7173, 0.7132, 0.7080, 0.7046 and 0.6978. Here, we follow the development of the downward structure of August 9. Short-term downward movement is possible in the area of 0.7173 - 0.7132. The breakdown of the last value should be accompanied by a pronounced downward movement. Here, the target is 0.7080. In the area of 0.7080 - 0.7046 is the consolidation of the price. The potential value for the bottom is the level of 0.6978, upon reaching which we expect a rollback to the top.

Short-term upward movement is possible in the area of 0.7260 - 0.7305. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.7373. This level is the key support for the downward structure.

The main trend is the downward structure of August 9.

Trading recommendations:

Buy: 0.7261 Take profit: 0.7303

Buy: 0.7306 Take profit: 0.7370

Sell: 0.7173 Take profit: 0.7134

Sell: 0.7130 Take profit: 0.7082

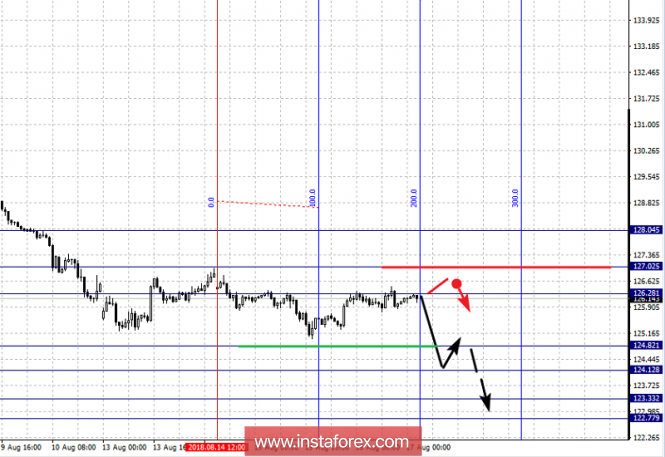

For the of EUR / JPY, the key levels on the scale of H1 are: 128.04, 127.02, 126.28, 125.72, 124.82, 124.12, 123.33 and 122.77. Here, the price forms a local structure for the bottom of August 14. The continuation of the movement downwards is expected after the breakdown of 124.82. In this case, the target is 124.12. Near this level the is the consolidation of the price. The level 124.10 break must be accompanied by a pronounced downward movement. In this case, the target is 122.77, upon reaching this level, we expect consolidation, and also a rollback to the top.

Short-term upward movement is possible in the area of 126.28 - 127.02. The breakdown of the last value will lead to the development of initial conditions for the upward cycle. In this case, the potential target is 128.04.

The main trend is the local structure for the bottom of August 14.

Trading recommendations:

Buy: 126.30 Take profit: 127.00

Buy: 127.05 Take profit: 128.00

Sell: 124.80 Take profit: 124.20

Sell: 124.10 Take profit: 123.35

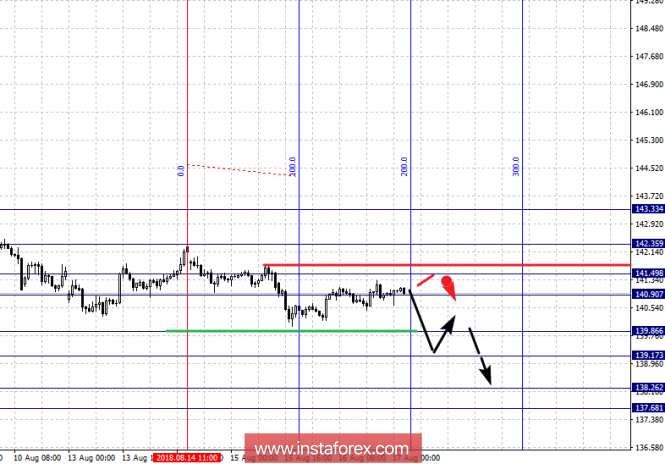

For the GBP / JPY pair, the key levels on the scale of H1 are: 142.35, 141.49, 140.90, 139.86, 139.17, 138.26 and 137.68. Here, the price forms a local downward structure from August 14. Short-term downtrend is possible in the area of 139.86 - 139.17. The breakdown of the last value will lead to the development of a pronounced movement. Here, the target is 138.26, the potential value for the bottom is the level of 137.68. Near which we expect consolidation, and also a rollback upward.

Short-term upward movement is possible in the area of 140.90 - 141.49. The breakdown of the latter value will lead to the development of an upward structure. Here, the target is 142.35. The potential value for the top is the level of 143.33, to which we expect the initial conditions to be formalized.

The main trend is the local structure for the bottom of August 14.

Trading recommendations:

Buy: 140.95 Take profit: 141.40

Buy: 141.55 Take profit: 142.35

Sell: 139.80 Take profit: 139.20

Sell: 139.15 Take profit: 138.30

The material has been provided by InstaForex Company - www.instaforex.com