AUD/USD has been quite volatile and indecisive recently at the edge of the 0.7310 area from where currently it is expected to push lower in the coming days. Despite AUD having better economic reports recently, it failed to maintain the momentum against USD which is expected to lead to further downward movement in the process.

So far, this week, AUD has been quite silent having no economic reports to impact the upcoming momentum in the pair, but tomorrow, AUD Private Capital Expenditure report is going to be published which is expected to increase to 0.6% from the previous value of 0.4% and Building Approvals is expected to decrease to -2.2% from the previous value of 6.4%.

On the USD side, today, USD Prelim GDP report is going to be published which is expected to have a slight decrease to 4.0% from the previous value of 4.1% and Pending Home Sales report is also expected to decrease to 0.3% from the previous value of 0.9%.

As of the current scenario, AUD has been forecasted to have mixed results while USD is expected to be quite dovish. Though USD is currently dominating the pair, certain volatility is expected until AUD reports are published tomorrow. If AUD performs poorly with the economic reports, USD is expected to extend its gains further despite the dovish economic reports.

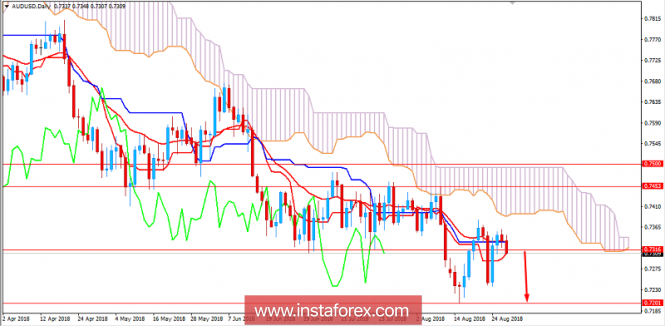

Now let us look at the technical view. The price is currently quite impulsive with the bearish pressure which is currently trying to break below the 0.7310 area with a daily close. Though the volatility and corrective phase are still active and a daily close below 0.7310 is expected to inject further impulsive momentum with target towards the 0.7200 and 0.7050 area in the coming days. As the price remains below 0.75 with a daily close, the bearish bias is expected to continue.

SUPPORT: 0.7310, 0.7200, 0.7050

RESISTANCE: 0.7450, 0.7500

BIAS: BEARISH

MOMENTUM: VOLATILE