GBP/USD has been quite impulsive with the bullish gains recently which lead the price above 1.2850 with a daily close. GBP having positive economic reports recently despite the rising tensions, the currency pushed higher against USD which is indeed quite remarkable.

GBP having pressures of Trade War and BREXIT, the currency was dominated consistently for a series of periods. Recently GBP Public Sector Net Borrowing report was published with a positive decrease to -2.9B from the previous figure of 3.3B which was expected to be at -2.1B. The positive report did help the currency to gain certain momentum having USD being silent without any economic reports recently. Though upcoming economic reports are forecasted to be dovish, any positive outcome on them is expected to inject further bullish pressure in the pair.

On the USD side, today FOMC Meeting Minutes report is going to be held which is expected to have a neutral impact on the USD gains in the process. Ahead of the Core Durable Goods Orders report to be published which is expected to increase to 0.5% from the previous value of 0.2% and FED Chair Powell's speech on Friday certain volatility is expected in the pair. Though USD has been the dominant currency in the pair but having Trade War to impact the USD as well, certain spikes may be observed in the process.

As of the current scenario, GBP gains currently is expected to sustain further until the upcoming high impact USD economic events and reports are published. Though USD is expected to have an upper hand in the long-term, the outcome of the upcoming events is expected to have a greater impact on the overall result and trend establishments.

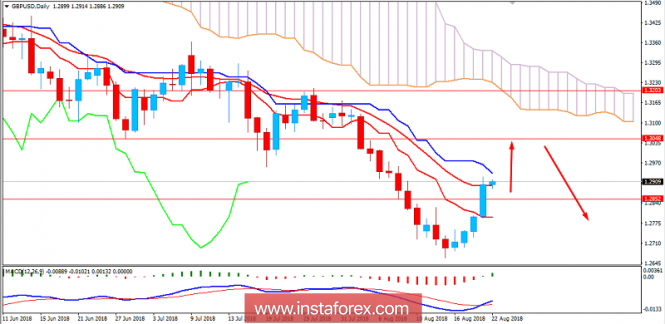

Now let us look at the technical view. The price has breached above 1.2850 with a strong bullish momentum which is expected to push the price higher towards 1.3050 area in the coming days from where the bearish momentum is expected to continue with the preceding trend in the process. As the price remains below the 1.3200 area with a daily close, the bearish bias is expected to continue further with a target towards 1.2550 in the future.

SUPPORT: 1.2850, 1.2550

RESISTANCE: 1.3050, 1.3200

LONG TERM BIAS: BEARISH

SHORT TERM BIAS: BULLISH

MOMENTUM: IMPULSIVE