The currency pair pound / yen in two weeks of August lost nearly 600 points against the background of Brexit's problems and the increased demand for protective tools.

Yesterday, the impulse of the downward movement was extinguished and the bulls were able to seize the initiative, especially since the need for price correction had long overdue and overhauled. But here, it is worth remembering that the pair is still within the southern trend, and judging by the monthly schedule, the "power reserve" allows you to decrease by a few hundred points, up to 137 figures, that is, to the bottom line of the Bollinger Bands indicator on MN. The prospect of further decline depends on two factors. First, the dynamics of the Turkish crisis, and secondly, the dynamics of the key macroeconomic indicators of Britain. Today and tomorrow, data on the market of the British labor market and inflation will be published. And although the fate of the interest rate now completely depends on the issue of Brexit, macroeconomic statistics can not be ignored either. Especially, if it is a pair of GBP / JPY in the context of a possible continuation of the southern trend.

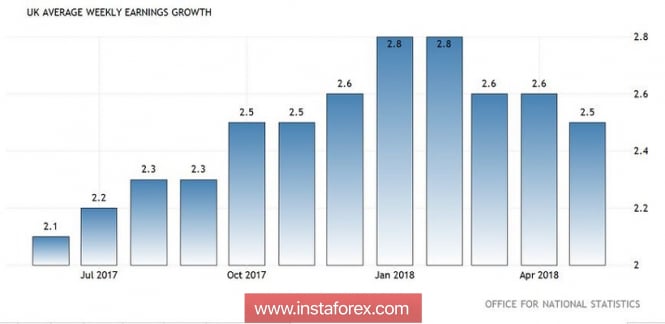

So, what do experts promise us? According to general forecasts, it is impossible to count on any breakthrough in the British indicators, indicators should either remain in the field of previous values or demonstrate a decline. Thus, the number of applications for unemployment benefits should be reduced to almost two thousand (the previous figure is 7.8K), and the unemployment rate remains at 4.2% (the figure is at this level since February this year). The dynamics of salary growth should also remain at the same level of 2.5%. This indicator has slowed down somewhat, if we speak about the general trend in the framework of this year.

In general, inflation indicators should also not impress traders. The consumer price index in monthly terms may "dive" into the negative area for the first time since January of this year. However, this will be the minimum deviation from the level of the previous month, when the release came out at zero level. In annual terms, the index should, on the contrary, add 0.1%, that is, reach the level of 2.5%. If we talk about core inflation, then the indicator should reach the previous level of 1.9%.

Thus, the predicted values of British statistics are not impressive. Therefore, if the real figures even deviate minimally from the forecast in the direction of decline, then the pound will again be under rather strong pressure. Moreover, the theme of Brexit is still not capable of supporting the British currency. Against the background of a temporary lull in the press, there is conflicting information about the intentions of Brussels and London. So, in early August, traders discussed the news that the EU is ready to make serious concessions, in particular, to allow Britain to remain in the single market, while retaining the right of free movement of goods. Officially, no one confirmed this information and refuted it.

Then, there were other rumors, more believable. According to one of the American news agencies, Britain will delay the negotiation process until the end of November to enlist the support of Donald Trump at the G20 summit. Until then, London will not sign any agreements, although previously the parties planned to agree on a framework agreement until October. Considering the fact that Brexit will in any case be held on March 29, 2019, Theresa May put the fate of the deal on the line. If the negotiations at the G20 summit fail, the probability of a "hard" Brexit will be almost 100%. However, this information is also a rumor, so the pound is under pressure of general nervousness.

The yen, in turn, traditionally follows an external fundamental background. Today, the panic in the foreign exchange market declined significantly, and this fact provoked craving for risky currencies. The reason for a certain detente was the meeting of the US president's adviser on national security with the Turkish ambassador to the United States. This meeting was initiated by the Turkish side (after the failed negotiations in late July), which means that Ankara is still looking for ways to normalize relations between countries.

Against the backdrop of such news, the Japanese currency became cheaper throughout the market, and the GBP / JPY currency pair was no exception. In general, trading this cross, you should remember two nuances. Firstly, the price for almost two weeks practically receded and reached a year and a half minimum, that is, corrective growth is inevitable (which we are now observing). Secondly, the pound's problems have not disappeared and can again remind themselves in the very near future. If the key indicators of the labor market and inflation in Britain go worse than expected, the British will easily lose all the positions he has won. The Brexit theme, which is still "on standby", can also interrupt the growth of the pound.

In other words, the growth of cross-pair GBP / JPY should be considered as a corrective recovery, but no more. The trend remains descending, the signals on all the "older" timeframes speak about this. On daily, weekly and monthly charts, Ichimoku Kinko Hyo generated a bearish "Line Parade" signal, and the price itself is between the middle and bottom lines of the Bollinger Bands indicator. Probable "ceiling" of corrective growth is located in the area of 144.50, this is the Tenkan-sen line on the weekly chart. This level of resistance to the bulls of the pair to break will not be easy, given the overall negative fundamental background of the pound.

The material has been provided by InstaForex Company - www.instaforex.com