Daily Outlook

In April 2018, the EUR/USD pair outlook turned to become bearish when the pair pursued trading below the broken uptrend as well as the lower limit of the depicted consolidation range.

Shortly after, the price zone (1.1850-1.1750) offered temporary bullish rejection towards 1.1990. The EUR/USD bulls failed to pursue towards higher bullish targets. Instead, a descending high was established around 1.1990.

This was followed by a bearish breakdown below the price zone of 1.1850-1.1750. This price zone has been standing as a significant Supply zone since June 2018.

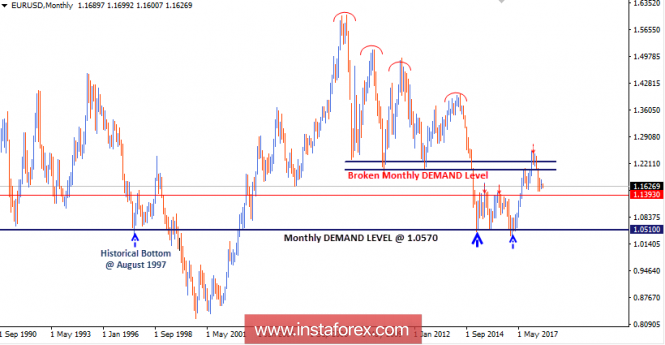

On the other hand, the price zone of 1.1520-1.1420 was considered a prominent demand zone where a valid bullish BUY entry was offered during previous weeks' consolidations.

On July 10, signs of bearish rejection were manifested around 1.1750. That's why a bearish movement was expected to occur towards 1.1650.

Lack of enough bearish momentum allowed another bullish pullback to occur again towards 1.1750 (the lower limit of the depicted supply zone) where another episode of bearish pressure was initiated this week.

That's why, the EUR/USD pair remains trapped within the consolidation range of 1.1750-1.1520 until breakout occurs in either direction.

Conservative traders should be waiting for a bullish breakout above 1.1750 as a valid bullish signal. Bullish targets would be located around 1.1850 and 1.1990.

The material has been provided by InstaForex Company - www.instaforex.com