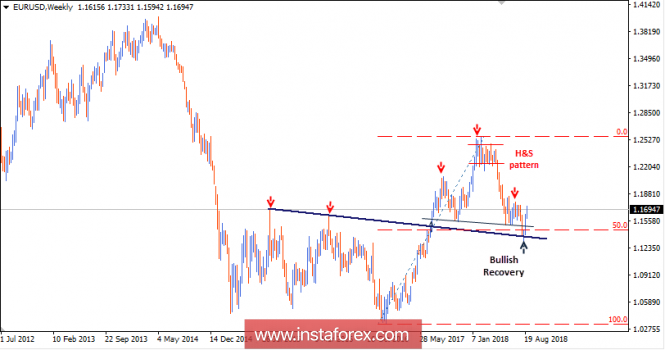

In April 2018, the EUR/USD pair outlook turned to become bearish when the pair pursued trading below the lower limit of the depicted consolidation range (1.2200).

The price level of 1.1500 offered temporary bullish recovery towards 1.1830. The EUR/USD bulls failed to pursue towards higher bullish targets. Instead, a descending high was established around 1.1800.

On the weekly chart, the EUR/USD pair tested the price zone of 1.1400-1.1300 where the depicted trend lines were located on the chart.

On August 10, temporary bearish closure below 1.1400 was achieved. This allowed further bearish decline towards 1.1300 where evident bullish recovery was demonstrated.

This week, the current bullish pullback is persisting above 1.1520, the bearish scenario would be hindered for the short-term. Further bullish advancement should be expected towards 1.1750.

Conservative traders should be watching the next price zone (1.1750-1.1850) for evident bearish rejection and a valid SELL entry. Initial Bearish targets would be located at 1.1550 and 1.1420.

On the other hand, For the weekly Head & Shoulders reversal pattern to be confirmed, the EUR/USD pair needs obvious bearish persistence below 1.1400.

Trade Recommendations:

The price zone of 1.1750-1.1850 should be watched for a valid SELL entry. S/L should be located above 1.1880. T/P levels to be located at 1.1550 and 1.1420.

The material has been provided by InstaForex Company - www.instaforex.com