The main outsider today is not the Russian ruble, but the New Zealand dollar, which not only collapsed to a two-year low, but continues to show bearish dynamics. The August meeting of the Reserve Bank of New Zealand was fatal for the national currency, and now, the currency pair NZD / USD, apparently, will occupy a new price niche.

The regulator has surpassed even the "softest" expectations of experts. The head of the RBNZ Adrian Orr, who was recently appointed to his post, said that the Central Bank decided to extend the forecast for maintaining the current rate. If the timeframe for possible tightening of monetary policy was earlier at the level of 2019, then this issue will not be considered until 2020. Moreover, according to Orr, the regulator does not exclude the option of lowering the interest rate level, "if it is necessary".

Here, it is worth recalling that a few months ago, the RBNZ took a more decisive position. And although the regulator did not deny that the monetary policy parameters will not change in the foreseeable future, the Central Bank insisted that the next step would be a rate hike rather than a decrease. Given this position, the market was oriented towards the second half of 2019 (October-December) and did not expect any surprises from the regulator earlier than the deadline. But the New Zealand Central Bank still surprised, it would seem, the "through" session turned into a real test for the traders of the currency pair NZD / USD.

The rhetoric of Adrian Orr helped the pair of bears to break through a strong support level of 0.6750, from 2016, the price has repeatedly approached this target, but each time it was repelled, thus forming a "bottom". It is noteworthy that after the impulse decrease, the price retracement did not follow, as is often the case in such cases (for example, the ruble, in pairing with the dollar, still tries to restore at least some of the lost positions). This suggests that the market has not fully played the news driver, and after a minimal correction, the decline will continue.

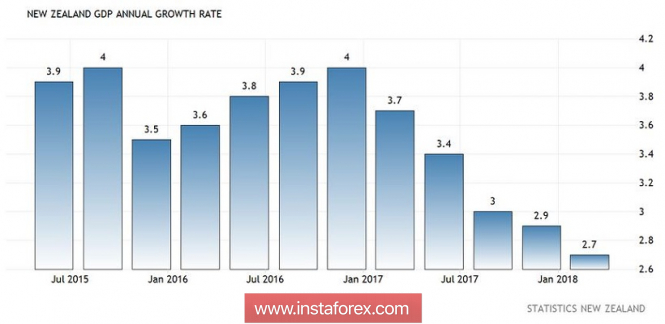

The fact is that the New Zealand dollar at the moment does not have any reasons for its own growth. In tandem with the US dollar, it can show a corrective growth only due to the weakening of the greenback. But, firstly, the US dollar is now in great shape, and, secondly, the effect of the August meeting will be felt for a long time. Central Bank of New Zealand outlined an extremely pessimistic picture. According to the head of the RBNZ, the prospects for the country's economy remain weak. This thesis is consistent with the opinion of the New Zealand Minister of Finance, who recently announced that the official forecast of GDP growth for the current year will be revised downward (from the current 2.8%).

The slowdown in economic growth is not the only problem. According to the latest data, the level of business confidence, as well as consumer confidence, has significantly decreased in the country. The real estate market has cooled down, the sector of production and, what is especially important for the island state, the service sector, shows a negative dynamics. Foreign trade is also not encouraging. In June, the trade balance deficit was unexpectedly fixed, with the general expectations of a surplus.

Separately, it is necessary to tell about inflationary dynamics. Consumer prices in New Zealand rose by 1.5% in the second quarter of this year, continuing to grow after growth of 1.1% y / y in the first quarter. However, first, most analysts expected more significant growth, and secondly, relative to the previous quarter, the CPI slowed in April-June to 0.4% (0.5% in January-March). Moreover, despite the aforementioned increase in inflation, prices for dairy products (which are so important for the New Zealand economy) continue to decline. The results of GDT auctions show that prices for almost all stock dairy products are falling, the weighted average price of the auction decreased by $ 86 with a stable supply growth. Since the beginning of June, the price index for dairy products has been in the negative area, and following the results of the last auction (which took place this Tuesday) was able to rise only to zero level. The offer, as before, significantly exceeds the demand in the dairy market, and this fact has a negative impact on the overall situation in this area. In addition, the devaluation of the yuan has created an additional challenge for Chinese importers, reducing their activity. By the way, RBNZ pointed out in a separate line that the risks for the country's export sector are growing in proportion to the growth of global trade tension. The hint of the US-China trade war is more than obvious.

Thus, the New Zealand regulator made it clear that over the next two years, it is not going to tighten monetary policy and if there are changes in the current parameters, then toward easing. This position will exert pressure on the currency pair NZD / USD for a long time, especially if the trade war between China and the US again will continue.

From the technical point of view, the situation is as follows. On all timeframes, the currency pair NZD / USD is on the bottom line of the Bollinger Bands indicator under all lines of the indicator Ichimoku Kinko Hyo, which formed a strong bearish signal "Line Parade". This indicates the clear advantage of the southern movement. Bearish momentum is so strong that it is too early to speak about price correction. Only if tomorrow's data on the growth of American inflation go much worse than expected, the bulls of the pair can expect a minimal price retracement. Otherwise, the priority will remain for the south. The main goal of the southern movement is at the lows of 2016, that is, at the base of the 65th figure. It is the mark of 0.6500 that will become the main barrier for bears NZD / USD.

The material has been provided by InstaForex Company - www.instaforex.com